Acko is a digital-first, direct-to-consumer insurance company founded in 2016 by Varun Dua, Chief Executive Officer. Acko operates technology and services platforms focusing on delivering exceptional customer experiences. The company is driven by its unwavering commitment to creating superior value propositions for customers and enhancing engagement.

In September 2017, Acko obtained its license from the Insurance Regulatory and Development Authority of India (IRDAI), enabling the company to offer innovative insurance products and services. Acko has adopted a fully online-led model, offering all its operations through digital platforms. This approach has helped the company deliver a seamless and efficient customer experience.

In 2021, Acko achieved unicorn status after securing $255 million in its latest funding round, becoming the 34th Indian unicorn of the year. The funding round was spearheaded by private equity firms General Atlantic and Multiples Private Equity, with participation from Canada Pension Plan Investment Board, Lightspeed Growth, and existing investors Intact Ventures and Munich Re Ventures. With its valuation now at $1.1 billion, the startup has raised $450 million.

Headquartered in Bangalore, Acko has successfully disrupted the traditional insurance industry by leveraging technology and customer-centricity. The company’s innovative approach has enabled it to provide comprehensive insurance products and services that meet the evolving needs of its customers.

Acko – Target Audience

Acko – Marketing Mix

Acko – Marketing Strategies

Acko – Marketing Campaigns

Acko Insurance Advertisement | Acko Bike Insurance Advertisemnt

Acko – Target Audience

Savvy Individual Consumer

Acko has carved a niche for itself by catering to individual consumers who are well-versed with technology and prefer managing their insurance needs digitally. This segment of Acko’s customer base prioritises products that offer convenience, competitive pricing, and clear communication. To meet these expectations, Acko provides a comprehensive range of digital insurance products, including car, bike, gadget, and health insurance policies, all designed with the modern consumer in mind.

Customised Insurance Offerings for Corporate Customers

Acko extends its innovative insurance solutions to the corporate sector by partnering with leading e-commerce platforms, ride-hailing services, and food delivery companies, including giants like Amazon, Ola, and Zomato. These collaborations are focused on delivering tailor-made insurance solutions that benefit companies and their clientele, ensuring a safety net for employees and customers through unique, customised policies.

E – commerce and Online Service Seekers

Recognising the growing demand for added value in online transactions, Acko strategically partnered with e-commerce platforms and service providers. These partnerships are designed to integrate Acko’s insurance products as value-added services, offering customers innovative insurance solutions that enhance their overall experience. This segment of Acko’s strategy targets consumers looking for more from their online interactions, offering them peace of mind and additional benefits as they shop, commute, or order food online.

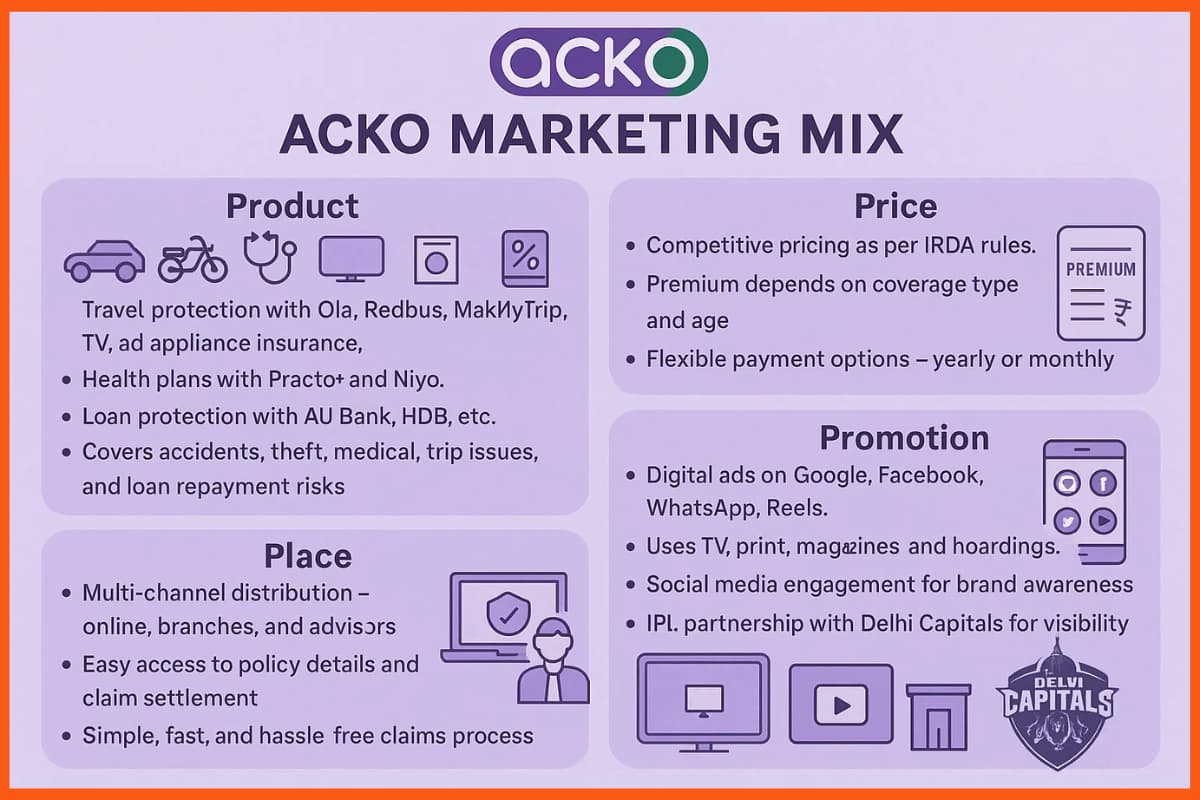

Acko – Marketing Mix

Product

Acko General Insurance offers a diverse range of insurance plans to cater to the varying needs of its customers. The company’s product portfolio includes car insurance, bike insurance, health insurance, mobile repair, and TV and appliance repair. Acko’s car insurance plans provide comprehensive coverage against accidents, theft, and damage caused to third-party property. Similarly, the bike insurance plans cover accidental damage, theft, and third-party liability.

Apart from these, Acko has collaborated with numerous travel and trip service providers such as Ola, Redbus, MakeMyTrip, and others to offer travel and trip protection plans. These plans cover various aspects of travel, such as trip cancellation, medical emergencies, flight delays, and lost baggage. Customers can choose from multiple plans depending on their needs and travel itinerary.

For health plans, the company has tie-ups with Practo+ and Niyo. These collaborations enable Acko to offer numerous health insurance plans that cover hospitalisation expenses, critical illness, and preventive healthcare. The company’s health insurance plans are designed to meet the unique needs of its customers and provide them with comprehensive coverage for unexpected medical expenses.

Moreover, Acko collaborates with financial institutions such as AU Bank, HDB, and others to offer loan payment protection plans. These plans provide customers with financial security if they cannot repay their loans due to unforeseen circumstances such as job loss, critical illness, or accidental disability. Customers can choose from different loan payment protection plans depending on their loan amount and repayment tenure.

Price

Acko’s insurance policies are designed to provide comprehensive coverage to its customers. The pricing for these policies is based on several factors, including the type and level of coverage chosen by the customer, as well as the age of the insured individual.

Acko is committed to maintaining competitive pricing while adhering to all IRDA regulations. It offers yearly and monthly premium payment options to make it easier for customers to pay for their insurance.

Place

Acko adopts a multi-channel approach to disseminate its policies. Its branches, recruited insurance advisors, and online platforms are all utilised to ensure its customers have easy access to the policy information they need. One of the critical features of Acko’s customer-focused approach is its straightforward claim settlement process, designed to ensure that customers receive timely and hassle-free settlements.

Promotion

Acko General Insurance, a leading insurance provider in India, employs various promotional strategies to reach its target audience. The company embraces modern technologies and techniques to expand its reach and engage with potential customers. It leverages online advertising through Google Ad Network, Facebook, WhatsApp, and Reel Marketing to connect with its audience and promote its products and services.

Besides online advertising, Acko uses traditional marketing channels such as television, print media, magazines, hoardings, and various social media platforms to reach a wider audience. These promotional efforts help build a positive brand image and increase customer awareness about Acko’s products and services.

Furthermore, the company has partnered with the Delhi Capitals, one of the most popular Indian Premier League (IPL) teams, as its Official Insurance Partner. This partnership enhances Acko’s visibility and credibility as a trusted and reliable insurance provider.

Acko – Marketing Strategies

Segmentation, Targeting and Positioning(STP) of Audience

Segmentation involves breaking down the target market into approachable groups, with Acko focusing on economically developed cities as its primary audience. This segmentation allows the company to tailor its marketing efforts to specific regions and demographics.

In targeting, Acko focuses on the most attractive segments within its chosen markets. By targeting economically developed cities, the company seeks to reach more people within its desired demographic.

In terms of positioning, the brand has crafted a distinct image in the market by emphasising key attributes such as the absence of paperwork, no brokerage fees, and instant processing. These positioning strategies help Acko stand out from competitors and influence the perception of its target audience, reinforcing the company’s commitment to simplicity, transparency, and efficiency in insurance services.

Search Engine Optimisation

Acko has adopted an impressive SEO strategy that has resulted in many organic keywords, and they currently have an exceptional 90,500 organic keywords, which is amazing. This high number of organic keywords has significantly contributed to the brand’s online visibility, making it easier for potential customers to find them on search engines such as Google. This, in turn, has led to increased customer engagement and acquisition as more people are becoming aware of the company’s offerings. Acko’s SEO strategy has played a crucial role in enhancing the company’s online presence, an essential aspect of any modern business looking to succeed in the digital age.

Social Media Marketing

Acko General Insurance has adopted an active approach towards social media engagement by frequently posting interesting Q&A-based content that encourages its followers to participate in discussions. Additionally, the company rewards the best answers its followers provide, promoting its brand awareness and enhancing its brand image. The insurance provider’s social media content is designed to be highly promotional and engaging in nature, aimed at capturing the attention of its target audience and providing value to its followers. This strategy has proven effective in building and maintaining a solid online presence for Acko General Insurance.

Digital Partners

Acko has adopted a unique approach to customer acquisition that has disrupted the traditional marketing playbook. Instead of relying on expensive marketing campaigns to build brand awareness, it leverages digital platforms such as Amazon and Ola, already widely used by customers, to sell its insurance products. By doing so, the company can tap into the vast reach of these platforms and acquire customers at a much lower cost than traditional methods.

This strategy helps Acko save on marketing expenses. It gives them a significant distribution advantage, typically only available to large, established companies. By selling through digital platforms, the brand can reach a wider audience and offer its products to customers without a range. Yet, it is not considered allowed to gain a foothold in India’s highly competitive insurance market and establish itself as a player to watch.

Influencer Marketing

Acko has implemented a comprehensive marketing strategy to increase its brand visibility and capture the attention of its target audience. The company has leveraged the popularity of renowned celebrities such as Ayushman Khurana and Virat Kohli to feature in high-decibel campaigns across various digital, television, and outdoor channels. By doing so, this company has successfully maximised its share of voice in the market, effectively establishing itself as a significant player in the insurance space.

Furthermore, Acko has sponsored several youth-centric properties such as the Pro Kabaddi League and three IPL teams – Gujarat Titans, Kolkata Knight Riders, and Lucknow SuperGiants. These initiatives have helped the company reach out to its target audience more effectively and reinforced its brand image as a modern and innovative insurer that caters to the tech-savvy millennial generation.

Word of Mouth with Seamless Claims

Acko’s success is ensuring customers have a seamless claims settlement experience they are eager to share with their social circles. Using automation and data, the brand has streamlined the claim processing procedure to be quick and efficient while ensuring verification and fraud prevention measures are in place. This generates a strong sense of goodwill that customers willingly promote to their friends and family, resulting in the most effective and authentic form of marketing. By prioritising the entire customer lifecycle rather than just focusing on products or advertisements, Acko has achieved a level of word-of-mouth recognition that is hard for established and emerging competitors to replicate.

Content Marketing Strategies

Acko General Insurance uses simple and relatable digital marketing campaigns. They show everyday situations where people save money with Acko’s low insurance premiums. The ads clearly explain how easy it is to use their fully digital process.

On social media, Acko focuses on showing its different insurance products. They also highlight that there are no brokers involved and that claim settlements are quick and hassle-free.

Acko – Marketing Campaigns

Time Nahi Lagega

Acko has launched a new marketing campaign called “Time Nahi Lagega” to promote its fast and hassle-free claim settlement process. The campaign dispels the common belief that filing an insurance claim is time-consuming and complicated. It uses relatable and humorous comparisons to daily life situations to showcase the difference in the time to claim insurance through their company. Through this approach, Acko effectively communicates its product differentiation to its target audience and highlights that its insurance claim process is quick and easy.

Murgi Pehle Aaya Ya Anda?

A hen featured in a famous advertising video asking a man to choose Acko for car insurance. Acko has grown from India’s first digital insurer to the country’s fastest-growing insurance company. Acko is the best option for insurance. In the advertisement, Acko aims to inform customers about the ease and simplicity of their insurance claim process. They want to dispel the notion that filing claims can be complicated and time-consuming. The company wants to assure its customers that filing claims with them is quick and straightforward.

Blind date with Acko

Gender stereotypes have been prevalent in our society for years. However, Acko, as a company that provides car insurance, decided to challenge these stereotypes by conducting a blind test. They gave a terrible car ride to a group of people and asked them to guess who the driver was. Surprisingly, 85% of the participants answered that the opposite gender drove the car. But in reality, their same gender was behind the wheel—the video aimed to raise awareness about biases and how gender should not determine someone’s driving skills. The video’s content and marketing strategy were so compelling that it received many views.

Health Insurance ki Subah ho Gayi Mamu

Acko’s marketing campaign for its health insurance product, Acko Platinum Health Plan, made a bold statement with its launch titled ‘Health Insurance ki Subah ho Gayi Mamu’. The campaign featured the iconic characters of Munna Bhai and Circuit from the famous Indian film series, played by Sanjay Dutt and Arshad Warsi, respectively. The campaign, directed by Rajkumar Hirani, challenged the age-old norms of the health insurance system and highlighted the unique features of the Acko Platinum Health Plan, such as 100% bill payment, no room rent capping, and zero waiting period.

The campaign aimed to educate the audience about the benefits of health insurance products and simplify the process of buying and using health insurance. The use of beloved characters from popular Indian cinema and the involvement of a renowned filmmaker like Hirani helped the campaign stand out and capture the target audience’s attention. The campaign successfully generated buzz and interest in the Acko Platinum Health Plan, establishing a solid presence for the brand in the health insurance market.

Saif Ali Khan and Sara Ali Khan

Acko recently launched a marketing campaign that features the father-daughter duo Saif Ali Khan and Sara Ali Khan. The campaign, conceptualised by Leo Burnett, consists of three films that debunk traditional consumer beliefs surrounding motor insurance. The ads show a contrast between a millennial and a Gen X mindset regarding insurance decision-making, with Sara playing the millennial role and Saif as the Gen X parent. T

The campaign encourages viewers to embrace new-age methods of purchasing insurance. It highlights the benefits of choosing Acko, including substantial savings on new car insurance, hassle-free claim settlement via the Acko app, the freedom to choose preferred garages for car repairs, cashless settlement for predictable repairs, real-time repair updates, and convenient car-renewal options.

The campaign emphasises the importance of purchasing insurance directly from the insurer, with the potential to save up to Rs 36,000 on premiums. The ad films were promoted on television, social media, OTT, and digital platforms, aligning with the movie’s tone to ensure maximum impact and message delivery to the target audience. The media mix for the campaign also included radio and OOH. The campaign successfully highlighted the benefits of Acko’s motor insurance offerings. It encouraged viewers to consider new-age methods of purchasing insurance.

FAQs

What is Acko’s target audience?

Acko targets tech-savvy individual consumers, corporate customers, and e-commerce/online service seekers.

What are the key elements of Acko’s marketing mix?

Acko’s marketing mix includes diverse insurance products, competitive pricing, multi-channel distribution, and extensive promotional activities.

What are some of Acko’s key marketing strategies?

Acko’s key strategies include STP, SEO, social media marketing, digital partnerships, influencer marketing, and focus on seamless claims experience.

What are some of Acko’s notable marketing campaigns?

Acko’s campaigns include “Time Nahi Lagega”, “Murgi Pehle Aaya Ya Anda?”, “Blind date with Acko”, “Health Insurance ki Subah ho Gayi Mamu”, and campaigns featuring Saif Ali Khan and Sara Ali Khan.

Is Acko car insurance good?

Yes, Acko car insurance is good. It offers low premiums, a simple online process, and quick claim settlements.

Who owns insurance?

Varun Dua is the founder, CEO, and owner of Acko General Insurance, the digital insurance pioneer in India