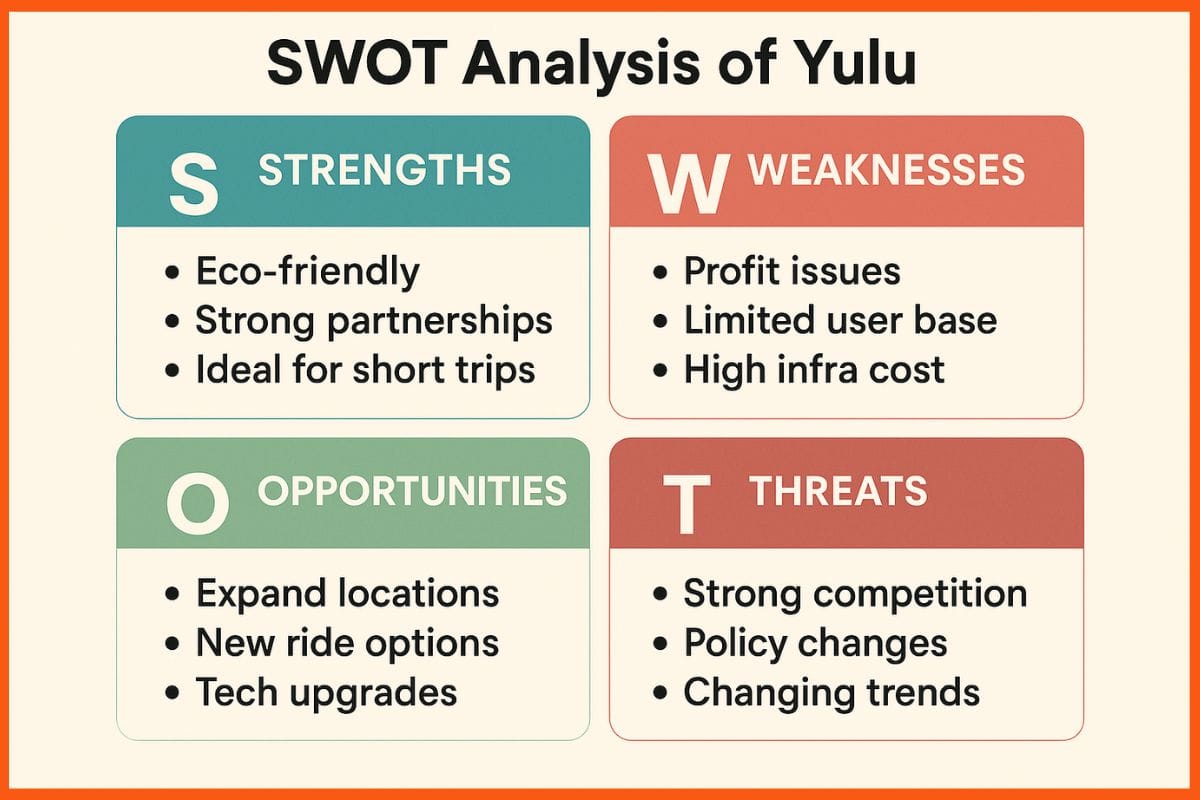

- UPI leads digital payments at 48%, Aadhaar banking preferred by 42% women respondents

- 38% Women respondents prefer a regional language smartphone interface for better customer engagement

- Smartphones, primary business device at 71%; among women, it’s even higher at 84%

- 79% women reported positive digital business impact

- 26% of MSMEs have attended training to build digital skills

- 7% of respondents are exploring AI-powered tools

The digital backbone of Bharat’s economy is strengthening. The third edition of the MSME Digital Index Report, released today by PayNearby, India’s leading branchless banking and digital network, reveals that over 73% of small businesses across semi-urban and rural India have seen increased income or improved operational efficiency as a result of adopting digital tools. With smartphones becoming the dominant mode of business management and UPI emerging as the most preferred transaction method, the findings indicate a deeper, more confident shift towards digital enablement at the last mile.

The third edition of the MSME Digital Index 2025 showcases digital consumption, tech awareness, behavioural patterns, and business transformation among micro-entrepreneurs, with a focus on gender representation. The insights were gathered through a nationwide survey conducted among 10,000 individuals and MSMEs in retail-focused segments such as kirana stores, mobile recharge outlets, medical shops, customer service points (CSPs), and travel agencies.

Smartphone usage remains central to their operations, with 71% of respondents citing it as their primary business device. Among women entrepreneurs, this number is significantly higher at 84%, indicating rising comfort with mobile-led infrastructure in driving customer engagement. Daily internet usage continues to rise, with 69% respondents consuming between 2GB to 5GB of data, largely supported by mobile hotspots, with 86% spending around INR 500–INR 1,000 per month on internet usage.

Digital payments continue to gain strong acceptance among MSMEs, with UPI emerging as the most preferred mode of transaction at 48%, followed by Aadhaar-enabled banking at 39%. Among women entrepreneurs, Aadhaar banking saw even higher preference at 42%, reflecting increasing trust in secure, tech-enabled services such as fingerprint and face authentication. These channels offer transaction efficiency and payment convenience, while also helping them build digital credibility for improved access to formal credit in the future.

The impact of going digital is becoming more tangible for small businesses. Of those reporting benefits from digital adoption, 33% cited improved operational efficiency. These insights point to a growing realisation among MSMEs that digital tools are not just convenient but critical for scaling businesses sustainably in a competitive market.

As digital tools become more embedded in daily business, the role of language and ease of use becomes increasingly important. 56% of respondents prefer English for understanding and navigating platforms, followed by Hindi at 25%. Among women entrepreneurs, 38% expressed a preference for vernacular interfaces, highlighting the continued need for regionally localised, intuitive tech platforms that better reflect how Bharat operates.

A small but notable 7% of respondents have begun exploring automated or AI-powered tools, including inventory apps, automated billing systems, and customer engagement platforms, mostly through third-party solutions. This emerging trend is reflected in the growing use of structured digital workflows such as transaction reports, WhatsApp-based follow-ups, and service-wise earnings tracking. It marks a shift toward more efficient, process-driven ways of working. These early signals point to rising curiosity and readiness among small businesses to explore advanced tools, as solutions become simpler to understand and use.

A growing number of respondents, both men and women, are actively building their skills to use these tools more effectively. Around 26% of respondents reported attending some form of training, whether through local community programs, online tutorials, or partner-led workshops. This reflects a shift from passive adoption to active learning, with small businesses showing increasing interest in building digital skills for long-term success.

Among women respondents, 79% reported that digital adoption had a measurable positive impact on their business performance. Nearly half said that access to digital services enabled them to contribute more actively to household finances, make independent decisions, or expand their customer base. Beyond financial gains, many also cited improved confidence in managing their businesses digitally, marking an early but important shift in long-term behavioural and social change.

The use of business software among MSMEs continues to evolve. Accounting tools are now used by 30% of respondents, followed by 18% using point-of-sale (POS) systems and 13% adopting customer relationship management (CRM) platforms. POS usage among women respondents has shown a notable increase, with 22% reporting adoption.

YouTube continues to be the most preferred entertainment platform, with 70% of respondents using it during leisure hours. Beyond entertainment, it is also widely accessed for learning, how-to videos, and brand-related content. WhatsApp and WhatsApp Business remain the most commonly used communication tools for business purposes across both male and female respondents, supporting activities such as product promotions, customer engagement, and order coordination. While the social and entertainment app landscape continues to evolve, the choice of platforms increasingly reflects business intent.

Commenting on the report findings, Anand Kumar Bajaj, Founder, MD & CEO, PayNearby, said, “The MSME sector is the backbone of Bharat’s economy, and the rapid adoption of digital tools such as smartphones, UPI, Aadhaar-enabled banking, and emerging AI workflows is proof that this segment is embracing modernisation. What stands out is not just usage, but growing digital confidence across the country. That confidence is enabling entrepreneurs to operate more efficiently and tap into formal financial systems with ease and transparency.”

“At PayNearby, our mission is to empower these change-makers by making technology intuitive, affordable, and focused on solving real business problems. From enabling banking at local retail touchpoints to opening access to credit through our partnerships, we are committed to equipping every retailer, entrepreneur, and household with the tools they need to prosper in a connected future.”

Commenting on the MSME Digital Index, Jayatri Dasgupta, CMO, PayNearby and Program Director, Digital Naari, said, “This year’s report highlights the growing participation of women in the digital economy, particularly across financial services and customer engagement. As more women take on entrepreneurial roles, it becomes essential to design solutions that are localised, easy to use, and built for convenience. Their engagement is creating tangible outcomes not just for their businesses but for their communities, accelerating change where it is needed most.”

“Women respondents, who accounted for 34% of this year’s sample, are demonstrating greater confidence in managing their business digitally. Through the Digital Naari programme, we continue to support the momentum by equipping women with the knowledge, tools, and support needed to become financially self-reliant and active contributors to Bharat’s digital progress.”

The MSME Digital Index 2025 reaffirms a clear message. As technology becomes integral to income generation, financial security, and enterprise growth, the need for cross-sector collaboration is more crucial than ever. Fintechs, policymakers, corporates, and community institutions must come together to remove residual barriers and build a digitally resilient MSME economy.

About PayNearby

Incepted in April 2016, PayNearby is a DPIIT-certified company and India’s leading branchless banking and digital network. PayNearby operates on a B2B2C model, where it partners with neighbourhood retail stores and enables them with the tools to provide digital and financial services to local communities. PayNearby’s mission is to make financial and digital services available to everyone, everywhere. The company aims to simplify high-end technology so that it can be easily assimilated at the last mile while transforming the lives of its retail partners and customers.

Today, through its tech-led DaaS (Distribution as a Service) network, PayNearby enables services like cash deposits, withdrawals, ecommerce, credit, insurance, travel, utility payments, and more. Currently, PayNearby’s 12+ lakh retail partners & 1.5+ lakh Digital Naaris spread across 20,000+ PIN codes assist over 5+ crore customers across the country, facilitating 25 crores yearly transactions.