If you are a shareholder in Infosys, this could be good news for you. Infosys is offering a big buyback of its shares worth ₹18,000 crore, at a 19% premium over the current share price. Notably, this is the largest buyback ever for Infosys. You might wonder if it’s all going too well for the company, and so it’s willing to buy back shares? Or is this a strategic move? Here’s everything you need to know about the buyback, the current price, the offered price, and more. Read below.

Infosys Buyback Key Details

- Infosys aims to buy 10 crore shares from its shareholders. They contribute to 2.41% of the company’s total shares.

- Each share has a face value of ₹5.

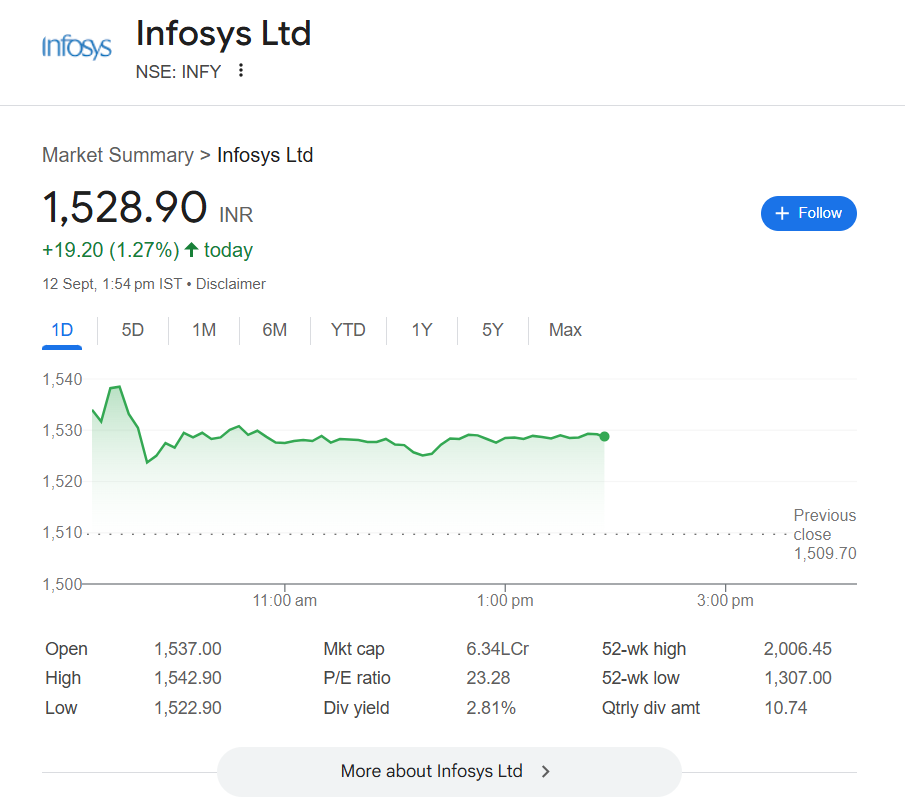

- The current market price for the shares (as of September 11, 2025) is ₹1,509.50 (BSE) and ₹1,512.20 (NSE).

Today it’s priced at:

- Now, Infosys is officially offering ₹1,800 per share, which is 19% more than the market price (closing price) on September 11, 2019.

What Happens in a Buyback for Investors?

It’s all up to you, if you want to hold the shares or sell them back to the company. In case you want to sell, you get ₹1,800/share. This means you are getting a premium of 14% more than the market value.

If you don’t want to sell, then you can keep the shares. It’s a plus to keep your shares, because the number of Infosys shares will go down, meaning they will become more valuable in the days to come.

Example

- Let’s say you hold 100 shares of Infosys.

- As of September 11, 2025, the market price is ₹1,509.50 (BSE) and ₹1,512.20 (NSE). Let’s consider that you get ₹1,510.

- If you sold them for the market, you would only get around ₹1,51,000.

- But, if you sold them to Infosys directly, you’ll get ₹1,80,000.

- An extra gain of ₹29,000 (before tax).

But here’s the thing, it’s not that easy to sell the shares:

Tender Offer System – Most buybacks happen via a tender system, meaning you’ll apply to sell the shares. And of course, the company won’t buy all of your shares.

Acceptance Ratio – The offered price is sure to attract many shareholders, and if the applications exceed expectations, the company only accepts a part of them.

Example: You offer 100 shares, but Infosys may buy only 40 of them.

- Additionally, the profit you make is a capital gain, so the tax applies accordingly. The company is still due for the shareholders’ approval.

- And after that, a Record Date and Tender Offer Period will be announced, and only then can you apply to your Demat Account.

Are Infosys’ Financials Supporting This?

Yes, because Infosys had a free cash flow of around ₹7,805 crore ($884 million) in the June 2025 quarter.

Previous Buybacks by Infosys:

The company has a history of buybacks, and this time around, it’s its largest to date. Here’s the timeline and price:

- 2017 → ₹13,000 crore at ₹1,150/share (11.3 crore shares were bought back successfully).

- 2019 → ₹8,260 crore.

- 2021 → ₹9,200 crore, with a max price of ₹1,750/share (that was around the time when IT took a boom).

- 2022 → ₹9,300 crore at ₹1,850/share.

- Now in 2025 → ₹18,000 crore at ₹1,800/share, it’s pretty evident, it’s the biggest ever.

Other Important Happening: Infosys + HanesBrands

The company also announced another major development along with the buyback: a 10-year partnership with HanesBrands Inc. (it’s a global apparel company).

They have partnered with Infosys because the company will help in:

- Using its LEAP (Live Enterprise Automation Platform).

- Using Infosys Topaz, an AI-first suite.

- Deploying generative AI and AIOps technologies.

- And overall digital transformation.

Leave a Reply