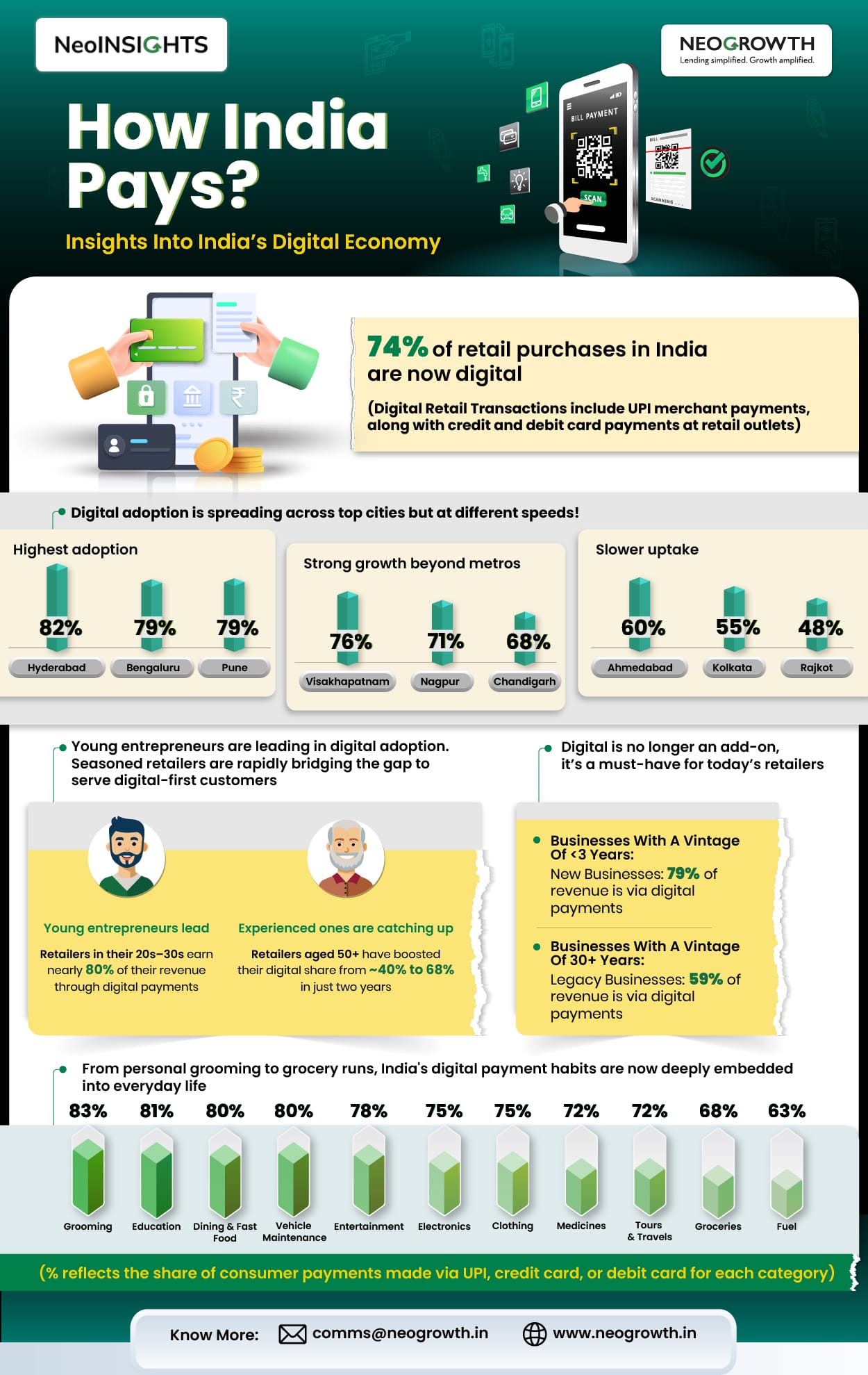

- Hyderabad (82%), Bengaluru (79%), and Pune (79%) lead the top-city rankings, while Visakhapatnam (76%), Nagpur (71%), and Chandigarh (68%) dominate beyond metros. • Ahmedabad (60%), Kolkata (55%), Jamshedpur (54%), Madurai (52%), and Rajkot (48%) show comparatively lower levels of digital adoption, highlighting the diversity in payment behaviours across cities

- Everyday categories like personal grooming (83%), education (81%) and dining (80%) lead the adoption charts, while groceries (68%) and fuel (63%) are fast catching up

- Nearly 80% business revenue of young retailers is coming from digital transactions; Seasoned entrepreneurs (age 50+) are catching up fast with 68%

- Smaller businesses (<₹1 Cr turnover) have 79% digital retail transactions, outpacing mid- and large-sized businesses

Digital retail transactions spanning UPI payments to merchants, credit cards, and debit cards have become an integral part of everyday retail spending, with usage continuing to rise across India. The top 29 cities in India are rapidly closing the digital gap, with digital spends now accounting for 74% of all retail transactions, up from 45% two years ago. In other words, out of every ₹100 spent on retail in these cities, ₹74 is paid digitally. This surge reflects a deep behavioural shift among consumers, who are increasingly choosing convenience and speed of transacting digitally, as revealed by NeoGrowth’s latest NeoInsights study released today.

The findings come at a time when India’s digital economy is poised to contribute nearly one-fifth of national income by 2029-30, making digital inclusion a key pillar of the country’s growth agenda. Government and industry data underscore the scale of this transformation, showing that nearly half of India’s total private consumption expenditure is now made through digital payments. With a larger share of private consumption now digital than in many advanced economies, it is a strong indicator of the country’s rapid progress towards a fully digital economy.

NeoGrowth, a new age digital lender known for offering quick and hassle-free business loans to MSMEs, drew insights from the banking behaviour of over 21,000 MSME retail outlets across 29 cities, covering an estimated ₹35,000+ crore in annual revenue. The 9th edition of NeoGrowth’s NeoInsights Report titled ‘How India Pays’ studied digital payment behaviour in the retail space. As India shifts to becoming a digitally empowered economy, in FY25 alone, digital retail transactions touched a staggering ~Rs 98 lakh crore, growing 23% year-on-year. By leveraging trends from the digital payments ecosystem, NeoGrowth has been able to create inclusive, data-led lending solutions tailored to India’s diverse MSME landscape.

Arun Nayyar, Managing Director and CEO of NeoGrowth said: “Digital payments in India have moved on from being an urban privilege to becoming a national standard. What we are witnessing is a behavioural transformation, powered by technology. From kiranas to kiosks, India’s retailers are redefining adoption and efficiency in digital modes of transacting. This is accelerating the formalisation of the economy by creating digital trails. At the same time, it’s generating rich data and laying the groundwork for more democratic access to credit. We believe this shift is not just about convenience of payment, it’s about trust in a future-ready ecosystem.”

**% of Digital Retail Transactions refers to the volume of Digital Retail Transactions, divided by business revenue.

City-Wise Adoption

The study revealed India’s digital payment habits are now deeply embedded in everyday life. From personal grooming (83%) to grocery runs (68%) to vehicle maintenance (80%), digital retail transactions rule across both discretionary and essential categories. While groceries (68%) and fuel (63%) are fast catching up.

Cities such as Hyderabad (82%), Bengaluru (79%), and Pune (79%) lead digital payments adoption in the top cities, while Visakhapatnam (76%), Nagpur (71%), and Chandigarh (68%) rank highest among the cities beyond metros.

In contrast, cities such as Ahmedabad (60%), Kolkata (55%), Jamshedpur (54%), Madurai (52%), and Rajkot (48%) still rely more on cash. The gap, however, is not due to lack of access – it may be a behavioural aspect. A higher dependency on cash-based transactions, coupled with resistance to changing familiar payment patterns, may have contributed to slow digital uptake.

Younger Retailers Lead the Way

By offering customers the choice to pay via UPI, credit cards, or debit cards, retailers play a decisive role in driving digital payment adoption. Young entrepreneurs in their 20s and 30s lead the way with nearly 80% of their business revenues now coming from digital modes. Interestingly, seasoned retailers aged 50s and above are also quickly closing the gap, with digital usage in their stores surging from close to 40% to nearly 68% in just two years.

Small Businesses Embrace Digital First

Contrary to traditional assumptions, the study finds that smaller businesses are ahead in the digital adoption curve. Retailers with turnover below Rs 1 crore stand at 79% of digital retail transactions, outpacing larger players. The larger players with a turnover of over Rs 5 crores stand at 63% of digital retail transactions. Early-stage businesses (under three years old) also show a high inclination to integrate digital payments into their operations from the outset.

For today’s retail entrants, digitally-enabled payments are not an add-on but a must-have, which positions them as key accelerators of India’s rapidly evolving digital payment ecosystem. This consistent digital footprint is not just reshaping how these businesses operate – it is also enhancing their route to formal credit. By leveraging this behaviour, NeoGrowth is able to underwrite and disburse business loans to MSMEs, helping them scale and have long-term growth.

Policy and Infrastructure Tailwinds

India’s transition to a digitally driven payment ecosystem is being shaped not just by evolving consumer and small business behaviour, but also by strong policy support. The Indian Government recently approved a Rs 1,500 crore UPI incentive scheme under the Zero MDR (Merchant Discount Rate) policy that keeps UPI and RuPay transactions free for merchants and customers. The JAM trinity and the expansion of BharatNet have laid a strong foundation. This, coupled with rising smartphone and internet penetration and the ease of app-based payments, is making digital transactions fast becoming second nature across the country.

As India marches towards its centennial as an independent nation, the digital economy is poised to contribute one-fifth of the country’s overall economy by 2030, surpassing traditional sectors such as agriculture and manufacturing. The ‘How India Pays’ report underscores that this digital revolution is not only urban, but increasingly Bharat-led, youth-powered, and retailer-enabled.

**% of Digital Retail Transactions refers to the volume of Digital Retail Transactions, divided by business revenue

About NeoGrowth

NeoGrowth is a new-age lender, with a focus on Micro, Small, and Medium Enterprises (MSMEs). It is a Middle Layer Non-Banking Financial Company (NBFC-ML), offering a wide range of products tailored to the dynamic needs of small businesses. Its data science and technology-led approach enable it to offer quick and hassle-free loans to MSMEs across 75+ segments across 25+ locations in India. NeoGrowth offers a unique daily repayment option to its customers with multi-channel repayment modes. It has served and engaged with 1,50,000+ businesses and supported them with their growth ambitions. It not only helps small businesses grow but also drives financial inclusion, making a positive social impact.

Founded by industry veterans, its Board of Directors comprises experts who guide the leadership team toward its strategic goals. NeoGrowth was founded by Dhruv Khaitan and Piyush Khaitan a decade ago and is backed by renowned investors, namely Omidyar Network, Lightrock, Khosla Impact, Accion Frontier Inclusion Fund – Quona Capital, 360 One Asset, FMO, and Leapfrog Investments.

About NeoInsights

Having served the needs of 1,50,000+ MSMEs since inception, NeoGrowth has deep customer connections across 70+ segments PAN India. Over the years, the company has gathered a large pool of data on MSMEs and the intelligent insights derived from this data are key to creating an enabling credit ecosystem for the MSMEs. Under NeoInsights, the company leverages its primary data and other sources to identify new and interesting trends in India’s evolving ecosystem, published in various formats, to ignite new ideas and share MSME sector trends with the industry.

**% of Digital Retail Transactions refers to the volume of Digital Retail Transactions, divided by business revenue

Leave a Reply