This article has been contributed by Manish Goyal, Chairman and Managing Director at Finkeda

The peaceful villages and fields of rural India are gradually being disrupted, altering a way of life that has existed for hundreds of years. For so long, businesses in these areas were either reliant exclusively on the feel of crumpled rupees or the trust that came from a handshake. The old way of banking, which often involved filling out long, complicated forms or going to branches that were so far away that it seemed impossible, was very difficult. But today, thanks to a powerful wave of digital transformation driven by pricing and government ambition, barriers are being broken down. This story is about how banking is moving from physical locations to the palm of your hand, bringing millions into the official economy and creating a future where financial inclusion is a basic right, not just a luxury.

The Foundation of a Digital Economy

The success of digital banking in rural regions relies on three key elements: Jan Dhan, Aadhaar, and Mobile, often called the JAM Trinity. The Pradhan Mantri Jan Dhan Yojana (PMJDY), started in 2014, aimed to give a bank account to every adult who didn’t have one. These “zero-balance” accounts allowed millions of people to join the formal financial system for the first time. The Aadhaar system provided every citizen with a digital identity, making it easier to open an account without needing a lot of documents. Plus, the fact that mobile phones are available even in faraway villages helped a lot. Together, these three things created a system where people could open a bank account just by using their fingerprints and get banking services from a nearby agent, making banking available to everyone.

UPI and AePS

The most noticeable part of this change is the rise of digital payments. The Unified Payments Interface (UPI) is a system that lets people transfer money instantly between bank accounts using an easy mobile app, and it has become super popular. The effectiveness of UPI lies in its simplicity. To transfer or receive money, users just need a mobile number or a unique UPI ID, which cuts out the hassle of complex account numbers and codes. Now, making digital payments is as straightforward as sending a text message. For instance, a farmer can now get paid for their crops directly into their bank account with just one click, and a small shopkeeper can take digital payments from customers using a QR code. The number of UPI transactions has increased a lot, showing how widely accepted it is in rural areas.

Another thing to note is that the Aadhaar-enabled Payment System (AePS) complements UPI by providing essential financial services to those without smartphones or internet. It allows users to carry out simple banking activities like cash withdrawals or balance inquiries using their Aadhaar number and a fingerprint scanner. Local helpers, called Bank Mitras, use these user-friendly devices to offer a mini banking experience right at the doorstep of villagers. This technology is particularly beneficial for seniors or anyone who finds reading and writing challenging, as it spares them from navigating complex digital platforms.

Unlocking Financial Freedom

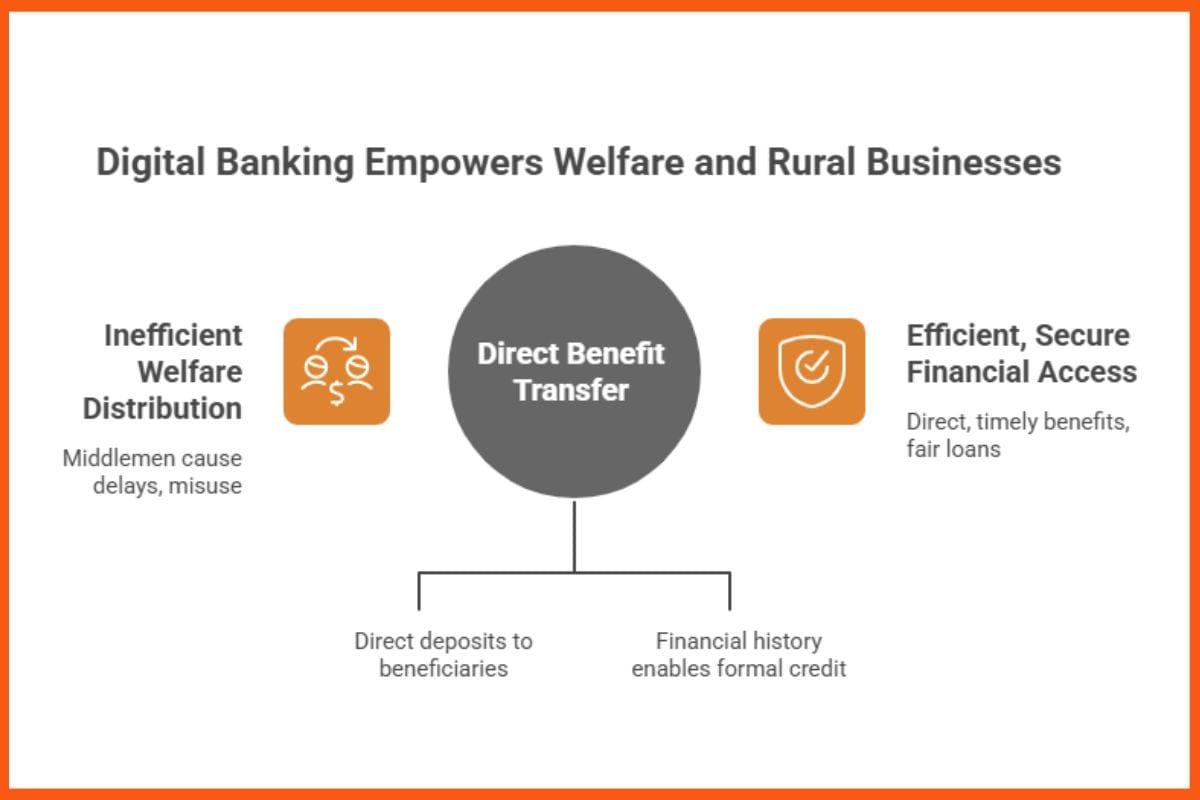

The shift to digital banking has completely transformed the way the government manages welfare programs. The Direct Benefit Transfer (DBT) system allows government assistance and benefits to be deposited directly into the bank accounts of those in need. In the past, this money usually passed through a lot of middlemen, which led to delays and sometimes even misuse. Now, by directly sending money to the bank accounts created under PMJDY, the government has made the process easier and more efficient. This means that a farmer’s crop subsidy, a senior citizen’s pension, or a student’s scholarship is received completely and on time. This easy way of transferring money has not only helped the government save money but has also given people a feeling of security and control over their finances.

Also, besides what the government is doing, digital banking is helping rural entrepreneurs and small businesses, too. With a real bank account and a record of digital transactions, people can now create a financial history, which helps them get loans. Having access to formal credit is really important for them to grow their businesses or invest in new ideas. A new trend is emerging with small business owners in rural India who are moving away from local moneylenders and are now able to access fair and affordable loans from banks. This marks a significant advancement in creating a more robust and inclusive rural economy.

The Path Forward

The transition from traditional banking to online banking in rural India is still underway. Initiatives like UPI and AePS have shown how technology can enhance financial inclusion, but there’s still much more to accomplish. Fintech companies are crucial in providing new, user-friendly apps and services that meet the needs of those in rural areas.

It’s not just about moving from cash to digital payments. It’s about building a system that enables every Indian, regardless of where they live, to manage their finances, save for the future, and support themselves, which in turn helps the economy of India. The transition to digital banking is linking urban and rural India, creating a future where financial services are available to everyone, not just a select few.

Leave a Reply