WeWork India launched an Initial Public Offering (IPO) worth ₹3,000 crore today (October 3, 2025). It’s a company that caters to creating flexible workspace solutions (either through leasing or transforming a building into modern office setups). According to the PIB website, there are over 505,000 startups in India, indicating that many would require office spaces to accommodate their staff. And many wonder with questions. Is it a good long-term investment? What does the grey market say about the stock and the gains? What are the risks and concerns? Should you invest? For all that, learn more.

Key Details of This IPO

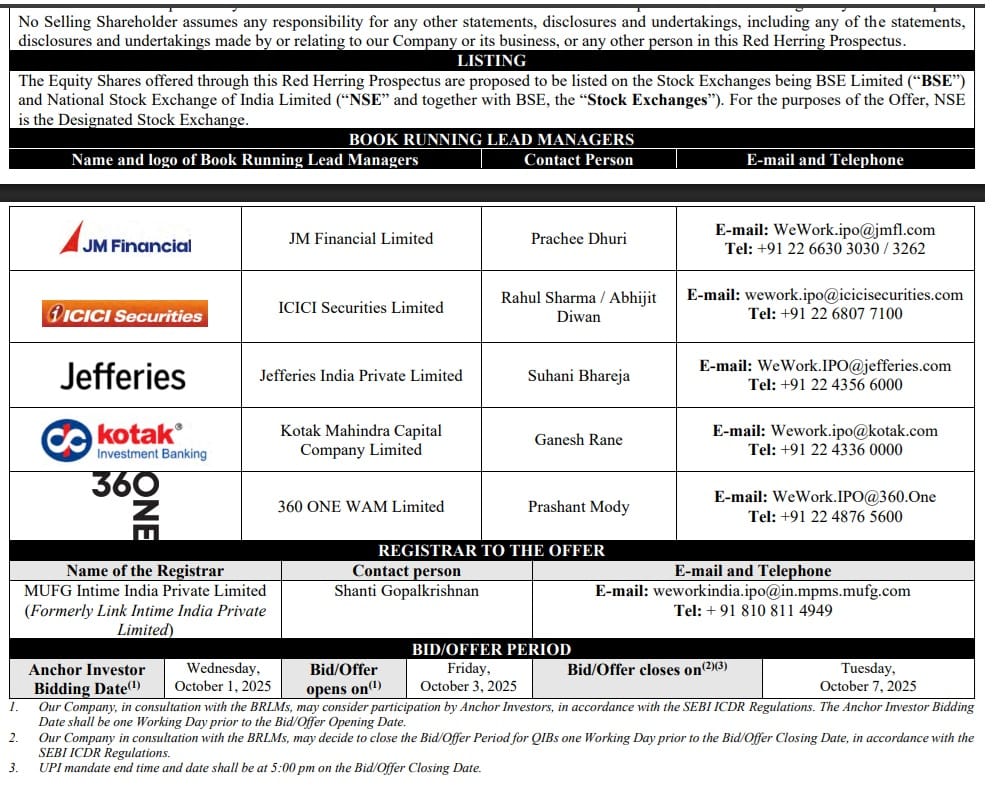

Dates:

- The subscription opened on October 3, 2025

- The subscription closes on October 7, 2025

- Allotment (meaning, deciding on who gets shares): October 8, 2025

- Listing (meaning, it’s when shares start trading on stock exchanges): October 10, 2025 (NSE & BSE).

Price band of shares: INR 615 – INR 648 per share.

Shares on offer: About INR 4.63 crore shares.

- If the stocks are sold at the highest price (INR 648), then the total IPO value sums up to INR 3,000 crore.

Type of Issue: It’s 100% Offer for Sale (OFS)

- This means that the company is not issuing any new shares; only the shares held by promoters and investors are being traded.

- Therefore, the money will not go to WeWork India.

- Anchor investors (big early investors): Before going public, the company raised INR 1,348 crore from 67 anchor investors at the top price of INR 648.

How Is the Subscription Going So Far?

- Today is day one (October 3), and the demand is apparently subdued, which means it is weak.

- Retail investors (general public) only subscribed to 7% of the stock by mid-morning.

Grey Market Premium (GMP)

- According to the Grey Market Premium (unofficial market), the stock is trading at ₹15 above the issue price.

- This means the market’s interest is currently moderate.

About WeWork India’s Business

WeWork is a leading co-working spaces provider in the country.

Business model is:

- Lease premium office spaces for the long term.

- Customise and design the workspace.

- Sub-let the office space to clients on flexible terms, such as shorter leases and membership options.

Financials

- The revenue-to-rent multiple of WeWork is 2.7 times. This number outperforms many of its competitors in the market.

Risks and Concerns

The company receives nothing from this IPO, so it has no new funds to grow.

High lease commitments: This means its clients have to pay massive rent regardless of whether their offices are fully occupied or not.

Risk:

- If the occupancy of the workspaces drops → profits will fall too.

- Clients can renegotiate for lower rents.

Past losses and pending legal issues: A petition has been filed accusing the company of making misstatements in its disclosures. Regulatory uncertainty in this market is also a risk.

What Analysts Are Saying?

- They say that the demand for the stock is lukewarm. However, subscription from big investors (QIBs, HNIs) may say how strong the IPO will be in the days to come.

- The market outlook is optimistic as the co-working spaces and modern offices are in demand (a growing market).

Leave a Reply