This article has been contributed by Rahul Rajendran, Vice President, WSB Real Estate Partners

India’s premium and luxury housing has experienced a remarkable surge in the past few years. According to a recent industry report, nearly 50 ultra luxury homes with a ticket size of INR 100cr+ have been sold in the past 3 years across Mumbai and Delhi NCR markets, amounting up to a cumulative sale value of ~INR 7,500cr. About half of these transactions – ~INR 3,650cr – occurred in 2024 itself. As 2025 began, the momentum continued, with 4 ultra luxury sales amounting to a total sale value of ~INR 850cr occurring within just the first two months.

India’s real estate market has been predominantly driven by mid-income and affordable housing, where developers focused on high volumes at lower ticket prices, and luxury homes were achievable to a narrow segment of buyers. Today, the picture is quite different. The question now, though, is not whether this segment will collapse – most analysts agree it will not – but more so whether this pace of growth is sustainable.

The Uneven Geography of Luxury

Luxury in India is very city-specific and remains concentrated in certain cities and neighbourhoods. Take Mumbai, where supply is tight, and demand from new-age wealth and generational businesses is insatiable. According to another recent industry report, in H1 2025, homes priced INR 10cr and above accounted for over 690 transactions ~INR14,750cr, across primary and resale markets. Yet when compared against the overall 47,035 residential sales in H1 2025, the luxury segment is just a sliver of the total transactions.

Delhi NCR tells a similar story, where luxury homes in areas such as Golf Course Road and Central Delhi see average ticket sizes in the INR 6–12cr range, reflecting robust demand from business families and HNIs. Meanwhile, in Bengaluru, where luxury has traditionally been a thinner market, saw sales in this segment rise ~59% in FY 2024-25 to merely INR 1000cr in value, while the city recorded a total of 26,599 residential units sold in H1 2025 across all segments.

Beyond these metros, other cities are gradually entering the map, though the definition of luxury differs highly from the metros. Hyderabad has witnessed luxury launches above INR 4–6cr, while Chennai’s elite zones have selective demand for homes priced around INR 5–7cr. Other cities such as Pune and Ahmedabad are still nascent in the segment, where “premium” is defined at lower thresholds – typically INR 3–5cr – and often targeted at NRIs or established business families.

This uneven distribution reflects the regional appetite for luxury living and displays that while luxury sales have gained momentum and captured the media attention, the segment remains a very small part of India’s housing market. The mid-income and affordable housing segment still contributes to a significant portion of the overall market demand and supply.

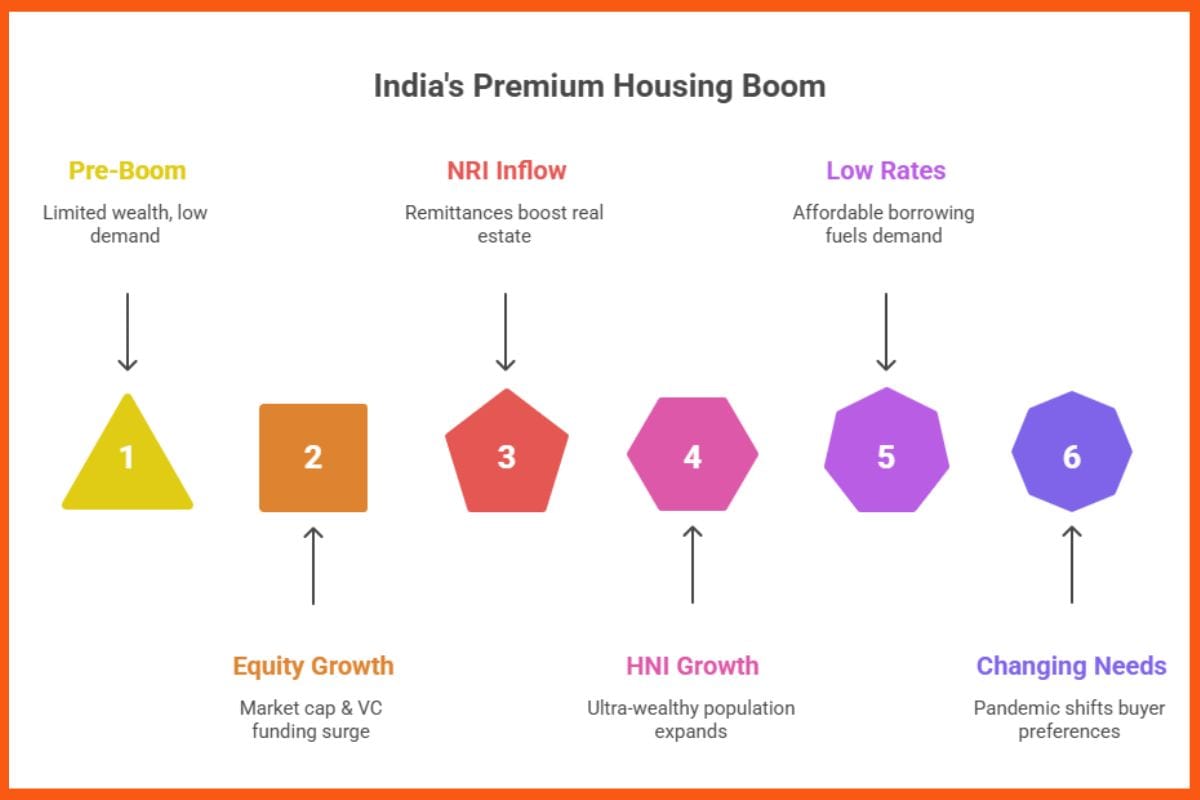

What Fueled the Boom?

- Equity Market Wealth Creation: India’s market capitalisation grew from around USD 1.5 trillion in 2014 to over USD 4.3 trillion by 2025. In addition to that, India saw a massive influx of Venture Capital funding between 2020-2023, totalling nearly USD 88 billion. This liquidity hallowed many startups to unlock substantial gains, which – until the INR 10cr cap on reinvestments came into effect in 2024 – could be allocated without limit into real estate, increasing the demand for premium, luxurious housing.

- NRI Inflow: Remittances increased nearly 14% y-o-y, reaching a record USD 135.5 billion in FY 2025. A significant portion has flowed into the real estate market, with NRI investments in the real estate industry estimated at USD 13 billion in 2023, and USD 3.1 billion in just the first six months of 2024. Developers such as DLF report over 20% of their FY 2024 sales were from NRIs.

- Growing HNI base: India had 85,698 individuals with assets of more than USD 10 million in 2024, a 6% rise from 2023. This number is projected to reach nearly 94,000 by 2028, making it one of the fastest ultra-wealthy expansions in the world.

- Low interest rates: Between 2020 and 2022, record-low interest rates improved affordability. Cheaper borrowing costs, easy access to credit, and abundant liquidity further fanned the demand for premium housing.

- Changing aspirations: The pandemic also reshaped buyers’ preferences. Buyers focused more on larger layouts, private terraces, wellness-oriented amenities, and branded residences, displaying a shift toward lifestyle-driven choices.

Balancing Momentum and Market Realities

Despite the sharp growth, questions are being raised about how long the momentum can last. Demand is still limited to a small group of HNIs and ultra-HNIs, many of whom already own more than one luxury home. For these individuals, buying is often a lifestyle choice rather than a real need. On top of that, policy changes are starting to weigh on sentiment. The new INR 10 crore cap on capital gains reinvestment, which came into effect in 2024, has reduced the tax benefits on high-value properties, slowing down some of the earlier rush in this space.

Secondly, supply is catching up. In H1 2025 Quarter to sell (QTS) in segments priced above INR 10cr continue to see longer sales cycles, with QTS extending beyond 16.1 quarters in some cases, particularly in Central and South Mumbai. Across India, inventory levels in the higher ticket sizes, particularly those in the INR 20-50cr category, have grown by 37% YoY. The QTS for units priced above INR 50cr is currently at 7.9 quarters, while it rises sharply to 17.1 quarters in the INR 20–50cr range. As a result, even marginal shifts in supply or availability can lead to significant fluctuations in QTS, rendering it more volatile over a relatively brief period.

Thus, the segment will remain relevant but is likely to grow at a measured pace.

Conclusion

India’s luxury housing market is still booming, especially in cities like Mumbai, Delhi-NCR, and Bengaluru. But the demand is coming from a limited group, the very wealthy and NRIs. Homes that are in the right location, backed by strong brands, and offer something special will continue to sell. Projects that don’t have these strengths may struggle to find buyers.

The boom will sober up rather than collapsing. The years ahead will reward developers who temper their ambition with caution, concentrating on prime sites and unique offerings. For the sector as a whole, the post-2020 surge will transition to a more stable and selective growth – resembling maturity and sustainability.

Leave a Reply