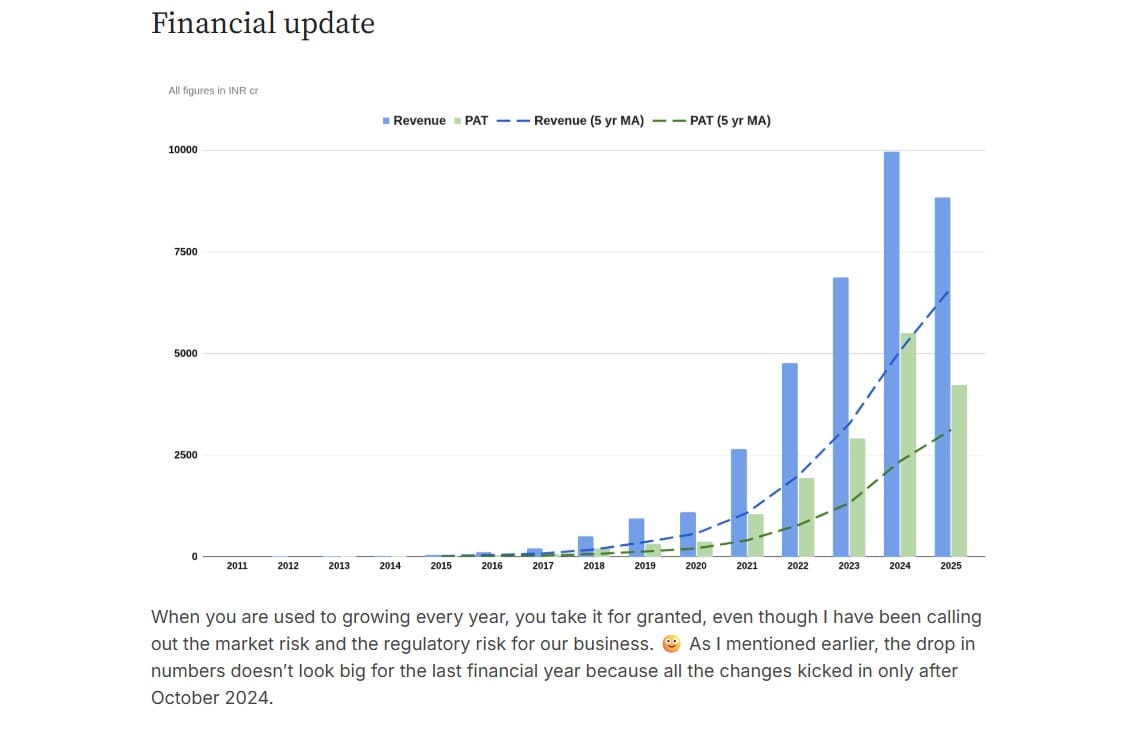

Zerodha (one of the biggest brokerage firms in India) is facing a revenue drop due to stricter SEBI regulations. Notably, the company’s numbers dropped by 15% (from INR 10,000 crore in FY24 to INR 8,500 crore in FY25). The profits dipped by INR 1300 crore (from ₹5,500 crore to ₹4,200 crore). This is not all; the prediction could be much worse, say a 40% revenue fall in FY26 (April 2025–March 2026). Why is the company struggling, while its competitors, such as Groww, are growing? What exactly are the reasons? Learn more.

What’s Happening With Zerodha?

Zerodha’s major earnings come from its customers trading stocks, futures & options, etc. As the new SEBI regulations came into effect, only a few are actively trading in the market, impacting Zerodha’s business numbers. Here’s what’s happening.

- Zerodha’s revenue dropped from INR 10,000 crore in FY24 to INR 8,500 crore in FY25 (a 15% drop).

- Its profits dipped from INR 5,500 crore to INR 4,200 crore.

- Here’s a big prediction that these dipped numbers can decrease by 40% compared to FY24.

Why Is Zerodha’s Revenue Dropping So Fast?

The major reason is the new SEBI regulations + less trading activity:

- STT (Securities Transaction Tax) on options was increased → So, this makes the trading of options very expensive, and only a smaller percentage can afford it.

- Weekly expiries cut to 2 contracts instead of multiple → Meaning it lowers the trading opportunities for the public.

- BSDA (Basic Services Demat Account) limit increased → This makes the demat account free for many or at least low-cost, so the brokers earn less.

- Exchange transaction charge rebates removed → Meaning that brokers can no longer get certain cost benefits.

- Overall market activity has slowed down → All of the reasons above lead to fewer trades = lower brokerage earnings for Zerodah.

Note: These rules came into effect in October 2024, so they didn’t impact FY24. But, FY25 and FY26 are going to hit the hardest.

Competition Situation

Groww is Zerodha’s biggest competitor, and it’s now preparing for an IPO:

- Groww’s revenue in FY25 grew 31% to ₹4,056 crore.

- Its profits skyrocketed 3x to ₹1,819 crore.

- The company only had a 10% revenue drop in the June quarter vs Zerodha’s 40% fall.

Note: The business numbers for Groww appear far better because the company offers a more diversified range of products. It is less dependent on options trading and more focused on creating wealth products.

- On the other hand, Angel One (it’s a listed company) is also facing similar heat, and revenue fell by 30%.

- Upstox also joins the list with active investors falling.

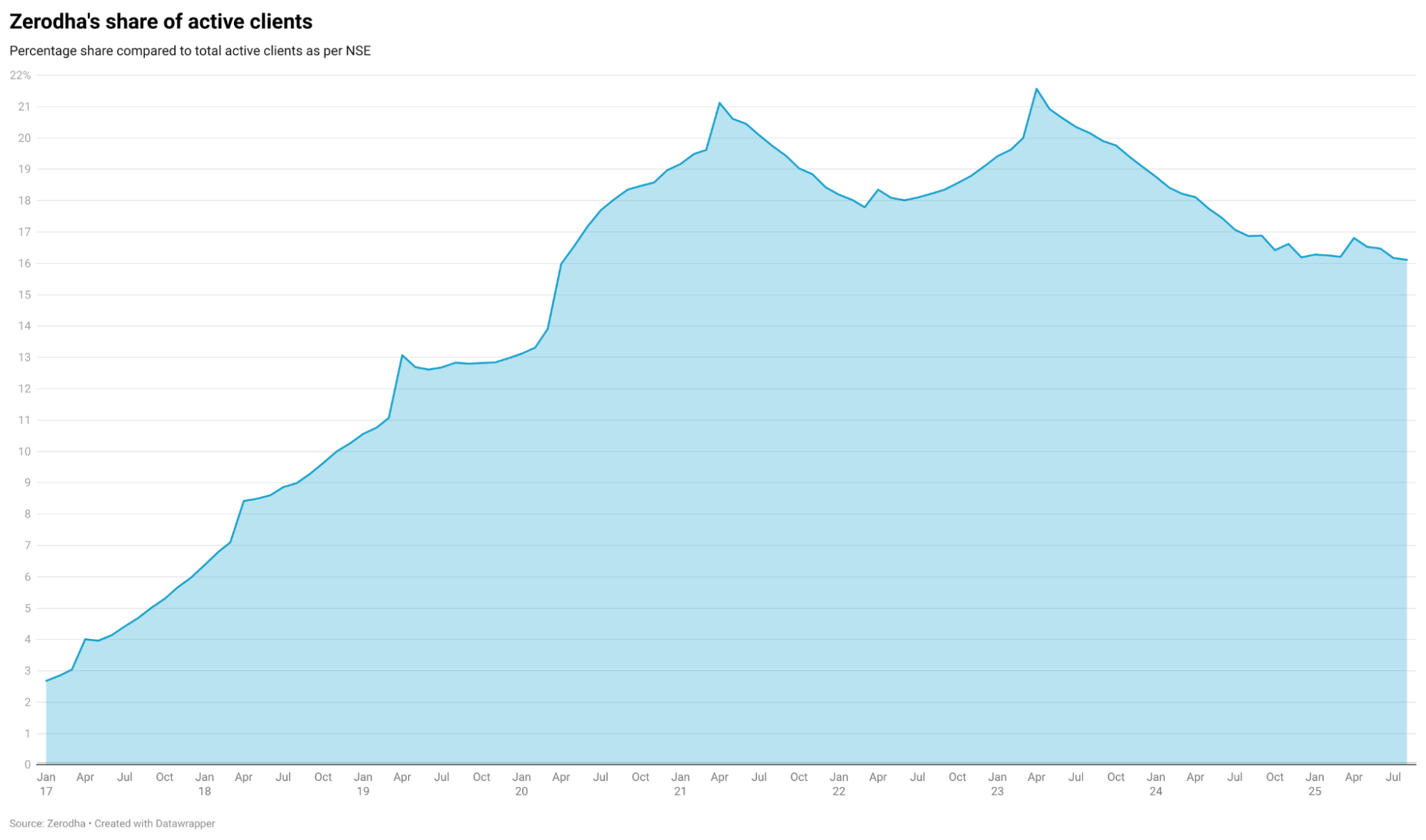

Market Share Shifts

- According to Zerodha, its active traders’ market share dropped from 22% (early 2023) to 16% now.

- However, the positive is that its client assets (AUM – Assets Under Management) still hold ~10% of all retail and HNI assets in India.

Note: The company has fewer traders on board, but it’s managing a large portion of its investors’ money.

Future Risks

- It’s huge that SEBI is considering removing the weekly options altogether. If this happens, then we can expect Zerodha to lose its biggest source of income.

- Here’s what could happen: to survive in the market, Zerodha may start charging brokerage fees on equity delivery trades, which are currently free.

Market Sentiment Overall

- India’s top 4 brokers (Groww, Zerodha, Angel One, and Upstox together have lost around 20 lakh active investors in 2025.

- In 2025, the companies alone have lost at least 6 lakh investors.

- Interestingly, all this happened at a time when stock markets were on the rise.

- It could mean one thing: that people have lost interest in Futures & Options (FF & O trading, not in equity investing.

- And the stricter rules are another drawback, reducing active participation in trading.

Leave a Reply