This article has been contributed by Sai Krishna Musunuru, Director & CEO of Payinstacard

In less than 10 years, the monetary system of India has changed drastically. It went through an extremely fast and turning point change, where it moved from cash-based transactions to one of the most digitally connected economies in the world. The National Payments Corporation of India (NPCI) is the one that has led such a change. It is the core of India’s digital payments ecosystem and is considered one of the most successful public-private digital payment initiatives all over the world.

Basically, the NPCI through its various innovations like the Unified Payments Interface (UPI), RuPay and Bharat Bill Payment System (BBPS), has completely changed how Indians make payments, save and transact their money. The convenience brought about by the organization is only a part of the story, as it has also allowed the economy at all levels to be more open, trusted and transparent.

The Genesis of a Payment Revolution

The purpose of setting up the National Payments Corporation of India (NPCI) in 2008 by the Reserve Bank of India (RBI) and the Indian Banks’ Association (IBA) was single-minded: to build a sturdy, interoperable payment and settlement system that would be fit for an economy with a billion people.

In those days, the financial system in India was disjointed and digital penetration was quite low; besides, the transaction costs were high. The launch of the Immediate Payment Service (IMPS) and later the Unified Payments Interface (UPI) facilitated the interoperability and the instant payment ecosystem to be established.

Every month, NPCI is performing multi-billion transactions through its network which are non-stop fund transfers, payments to merchants, and various programs to bring unbanked people into the banking fold under a secure and regulated system.

UPI: The Game-Changer

The start of UPI in 2016 was the flag-off that India’s digital trip took a new direction. UPI, designed as an open, interoperable protocol, made it possible for the clients to have more than one account linked to them and carry out instant transactions of real-time value through a simple mobile phone interface.

One of the great strengths of UPI is its cleverness and general standard. It does not depend on a particular app, bank, or device thus, any user located in the farthest corner of the country can make immediate money transfers simply by a few taps.

This framework not merely made payments more accessible to common people but also attracted huge innovations. Financial institutions, banks, and startups could now leverage UPI’s infrastructure, thus, escalating the competition and creativity. Consequently, digital transactions became open to billions who have never gone through the process of formal banking.

UPI is projected to handle more than one billion transactions per day by 2025, which basically means that no other system can have such a scale and be so reliable as UPI.

Driving Financial Inclusion Through Accessibility

The facilitation of transactions is not the only thing that NPCI does. However, low and very low-income people are also beneficiaries of the system, albeit to a lesser extent. It’s worth noting that the adoption of digital payments in India has been mainly driven by the affordability of mobile phones and Internet access, rather than by bank penetration or the level of financial literacy.

There has been a significant change in the digital payment ecosystem in the country post the advent of systems by NPCI. The shift has been from metros and affluent users to the entire country where digital finance has become accessible through UPI, RuPay, F, and BBPS, allowing participation in the formal economy by millions.

The integration of services such as Aadhaar-based authentication and offline UPI Lite transactions has enabled even feature phone users to join the digital bandwagon. Small businesses and micro-entrepreneurs made it easy to accept digital payments by using UPI QR codes and charging very low transaction fees.

This inclusionary model has made the switch to digital payments from a privilege into a public utility (the next and very important step towards the realisation of India’s vision of a nearly cash-light economy).

Catalyst for Trust and Transparency

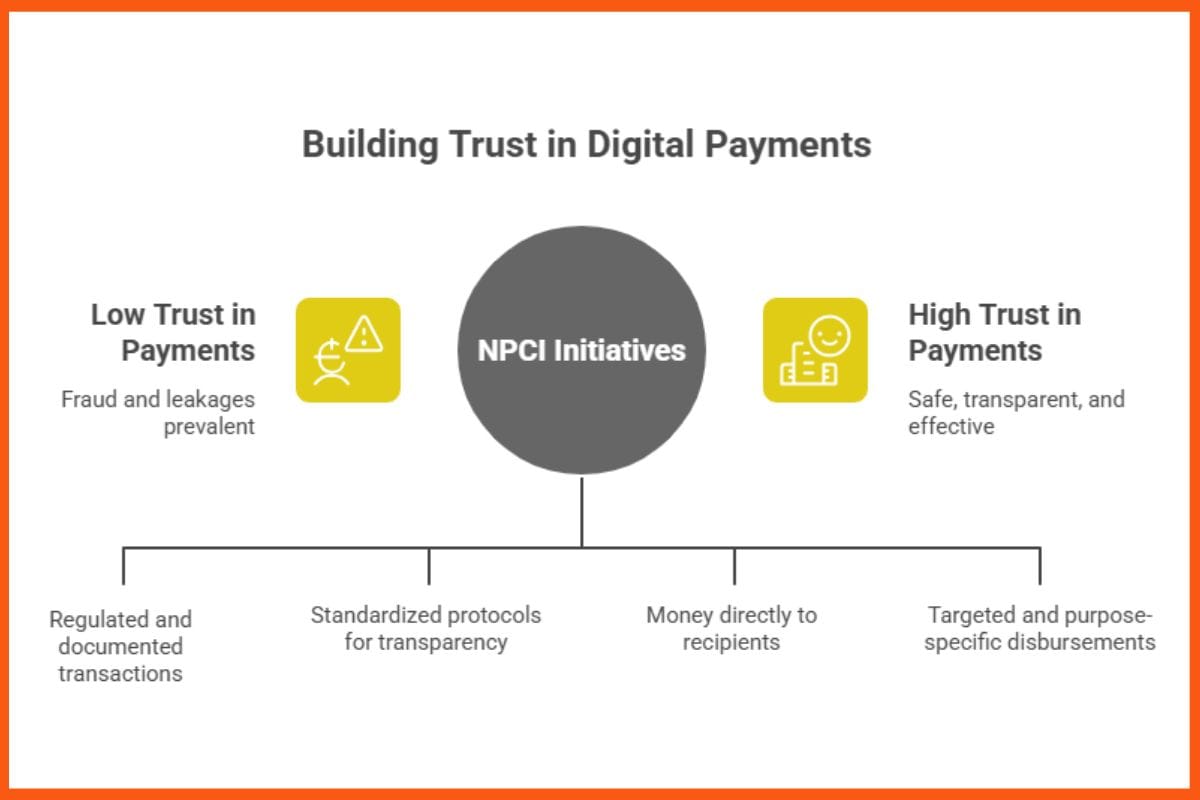

NPCI is among one of those who have helped very much in the digital payment ecosystem to build trust. Their design allows for safe, well-regulated, and documented transactions, which reduces the cases of fraud and thus, increases the trust of the users.

NPCI by implementing interoperability and standardized protocols has made digital payments to be transparent and open for inspection, which has been a major factor in fighting leakages in government subsidies and welfare schemes. For example, Direct Benefit Transfers (DBTs) are currently done by crediting the money directly into the accounts of the recipients without any intermediaries thus, guaranteeing both the effectiveness and the monitoring of the process.

In addition, e-RUPI, a digital voucher system, is one of the programs which reflect NPCI’s innovative mindset towards targeted and purpose-specific disbursements, allowing the government and public welfare to benefit from fintech innovation.

Policy Push: The Backbone of India’s Digital Payment Growth

Policy ecosystems fundamentally aided NPCI to achieve one of its major successes; the Reserve Bank of India (RBI) and The Government of India put in such an ecosystem. Though Digital India, Pradhan Mantri Jan Dhan Yojana (PMJDY), and Aadhaar were significant moves that ensured digital inclusion, regulatory support was essential in preserving the security and standardization of various platforms.

In fact, a scenario where both traditional banks and fintechs have an equal opportunity to operate has been created due to the RBIs continuous focus on interoperability, security, and affordability. Addressing the policies in particular that are designed to promote the adoption of digital transactions as well as consumer rights there are those that support merchants with zero-MDR transactions, organize financial literacy campaigns, and run cybersecurity awareness programs. Other vital frameworks are the Payment and Settlement Systems Act (2007), the main act for regulation and supervision of payment systems and the Data Protection Guidelines for Payment Systems that secure user information.

Alongside this, the Bharat BillPay, e-RUPI, and UPI Regulatory Framework schemes are the pillars of the digital economy that allow for hassle-free digital transactions and welfare programs beneficiary-specific implementation, thus, helping users and merchants.

It was not one single event that caused India to make it on the global list as a leader in digital payments, but the combination of foresight in regulation, public infrastructure, and relentless innovation were the game-changers. This instance in India is a vivid demonstration of how policy, technology and trust working together, can redefine a whole financial ecosystem and, thereby, millions of lives can be benefitted.

Adapting to Emerging Technologies

Another reason why NPCI is successful is that it has always been able to adjust its strategy to meet changing circumstances. The evolution of consumer needs and global fintech trends has brought NPCI to support traditional bank-led systems only to complete the integration of the most advanced technologies such as tokenization, contactless payments, and biometric authentication.

Biometric UPI authentication, for instance, the latest development that allows users to authenticate transactions with their fingerprints or facial features, is yet another step towards digital comfort and safety. Such breakthroughs are essential given the growth of the Indian digital landscape and the variety of cyber threats that have appeared.

Furthermore, NPCI’s endeavors to connect UPI with foreign payment networks beginning with nations like Singapore and the UAE reflect the goal of India to set UPI as the global payment standard.

Conclusion: Building the Digital Backbone of New India

NPCI’s impact on the shift to digital payments in India is a revolutionary change to the least degree. In fact, along with providing the technical infrastructure, it has also been the trust infrastructure that forms the basis of a digital economy of the modern era.

NPCI, by bringing banks, fintechs, consumers, and merchants all under one interoperable framework and thus, eliminating the need for any direct linkage, has changed the way India transacts altogether. In this manner, payments have become not only quicker but also safer and accessible to all

Having become the world’s benchmark for large-scale, inclusive digital transformation, India is now gazed upon by many and in this context, NPCI acts as a shining example of how policy, innovation, and public trust all together can enable a country to empower one transaction at a time.

Leave a Reply