Ather Energy’s stock has quietly turned into one of India’s most surprising market stories, jumping over 66% since its debut in May 2025. Its rival, Ola Electric Mobility, has taken a different road altogether, losing nearly a quarter of its value since going public last year.

Both companies are now locked in a fierce battle to own India’s fast-growing electric two-wheeler market, but their sharply contrasting stock charts tell a deeper story. Moreover, investors and EV enthusiasts alike are asking the same question: which brand has the horsepower to lead India’s EV industry, and which one deserves a spot in your portfolio?

In this article, we will find the answer to that question, comparing Ather and Ola Electric across their technology, market share, growth strategy, and financial performance to understand who’s really powering ahead in 2025.

How Ather Energy Built Its Path to Consistent Growth?

Ownership Structure: Key Promoters and Their Stakes

How Ather Surpassed Ola in the EV Market Rankings?

From Underdog to Dominator: Ather’s Rise in India’s Electric Two-Wheeler Market

Diverging Fortunes: Stocks and Sales Tell the Story

The Psychology Behind the Price: Understanding Market Sentiment

Stock Price Trends: Short-Term and Long-Term Perspective

The Financial Face-Off: Ather Surges as Ola Struggles

Investor Confidence: Ather’s Market Cap Tops Ola

Technology and Product Updates Driving Growth

Ola Electric: Ambitious Scale Meets Operational Challenges

The Ather Advantage: Engineering as a Superpower

How Ather Energy Built Its Path to Consistent Growth?

Unlike Ola, Ather scaled gradually, focusing on South India initially and expanding thoughtfully. Its strong demand for the 450 series and mass-market Ather Rizta helped maintain consistent sales growth. This methodical approach has also translated into stronger investor trust, with Ather’s stock more than doubling since its May 2025 IPO.

Ownership Structure: Key Promoters and Their Stakes

At the end of June, Ather’s promoters owned 42.09% of the company, with co-founders Mehta and Jain holding 11.19%, and Hero MotoCorp Ltd. owning 30.9%. This strong backing provides both financial stability and strategic support for future growth.

How Ather Surpassed Ola in the EV Market Rankings?

The latest quarterly sales numbers highlight the shift in market leadership:

- July–September 2025: Ather sold 52,597 scooters, surpassing Ola’s quarterly total amid a 47% year-on-year drop in Ola’s sales.

- September 2025 Rankings: TVS Motor topped the list with 69,195 units, Ather claimed second place, Bajaj followed with 51,120 units, and Ola slipped to fourth with 13,371 units sold, a stark fall from its earlier dominance.

This change in pecking order signals a turning tide in India’s EV market, reflecting both execution and market perception.

From Underdog to Dominator: Ather’s Rise in India’s Electric Two-Wheeler Market

Ather Energy, founded in 2013 by Tarun Mehta and Swapnil Jain, spent its early years quietly building a reputation for engineering excellence. It began delivering scooters in 2018, three years before Bhavish Aggarwal’s Ola Electric entered the market.

Ola, launched in 2017, made a splashy entry with its “Futurefactory” in Krishnagiri, Tamil Nadu, and began delivering its first scooters in December 2021. Backed by global investors like SoftBank, Ola’s scale and aggressive marketing quickly helped it capture over 50% of India’s EV two-wheeler market at its peak.

While Ola prioritized volume and nationwide reach, Ather focused on gradual expansion, customer satisfaction, and engineering innovation, creating a loyal and steadily growing user base.

Diverging Fortunes: Stocks and Sales Tell the Story

Shares of Ather Energy extended a six-day bull run, closing 1.6% higher at INR 639, while Ola Electric fell 2.57% to INR 51.27, reflecting growing investor caution. Ather’s stock signals confidence in sustainable growth and operational discipline, whereas Ola’s volatility highlights concerns over profitability, service, and execution.

This market sentiment mirrors their operational performance:

- Ola Electric: Sold 3.44 lakh scooters in FY2025, but sales plunged this year despite expanding stores from 800 to 4,000 and launching a new electric motorbike. Persistent service issues and integration of in-house battery cells have yet to offset negative sentiment.

- Ather Energy: Sold 1.3 lakh units, with consistent growth driven by the 450 series and Ather Rizta, reflecting steady execution and strong customer demand.

The combination of rising stock confidence and growing sales momentum positions Ather ahead, while Ola faces challenges in regaining investor trust and market leadership.

The Psychology Behind the Price: Understanding Market Sentiment

The market has taken note of this turnaround. Since its IPO in May 2025, Ather Energy’s shares have more than doubled, closing at INR 542.55 on September 12, up from a listing price of INR 326.05.

Ola Electric, on the other hand, has seen its stock slip over 31% below its August 2024 listing price, mirroring the dip in investor confidence as operational challenges mount.

Stock Price Trends: Short-Term and Long-Term Perspective

Investor sentiment has mirrored operational performance:

Ather Energy

- The stock surged over 94% in just three months, a remarkable gain reflecting strong market confidence.

- Listed on BSE and NSE on April 23, 2025, with a 52-week high of INR 678.50 (October 8, 2025) and a 52-week low of INR 287.30 (May 7, 2025).

- Current valuation has nearly doubled from its IPO price band, indicating robust investor faith in Ather’s strategy.

Ola Electric

- Shares rose over 25% in three months, but still trade below the IPO price band of INR 76.

- IPO launched in August 2024, with a year-to-date valuation decline of over 40%, highlighting persistent investor caution.

- High short-term volatility reflects market concerns over operational execution, margins, and customer satisfaction.

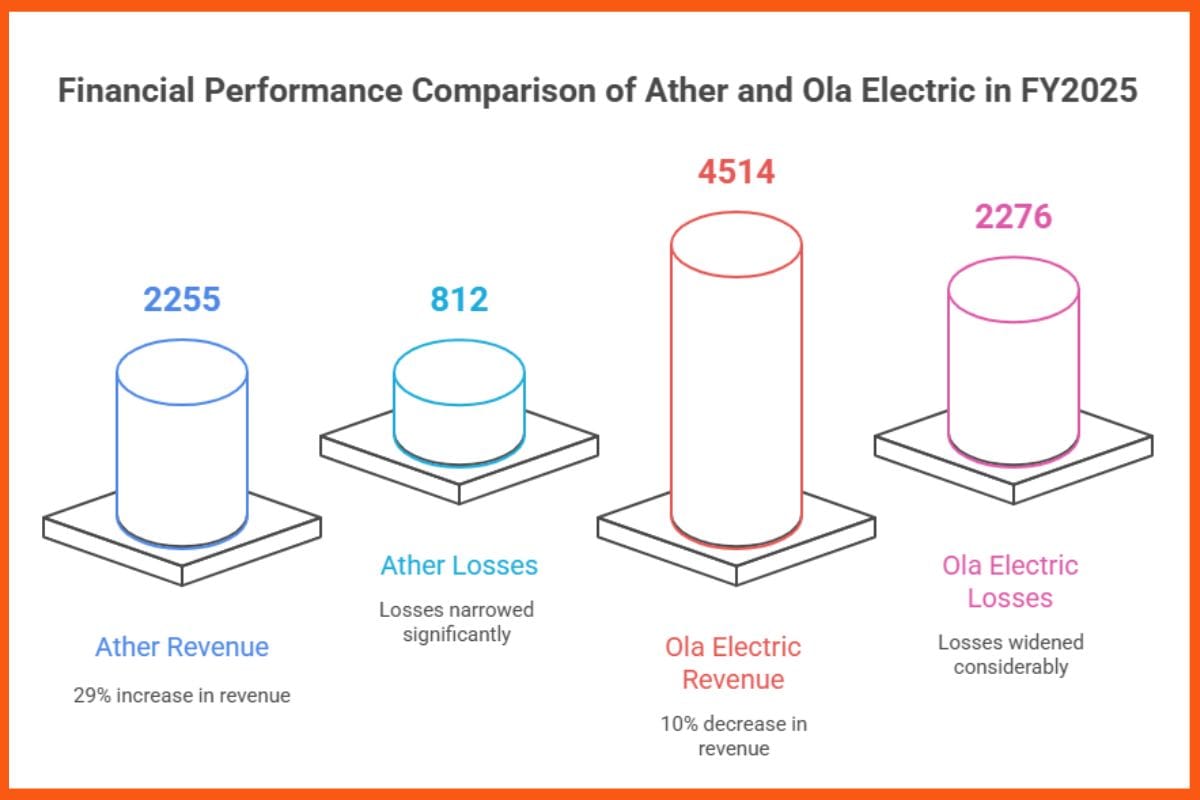

The Financial Face-Off: Ather Surges as Ola Struggles

Ather’s focus on efficiency and product engineering is beginning to pay off. In FY2025, the company’s revenue from operations rose 29% to INR 2,255 crore, while its losses narrowed to INR 812 crore, compared to INR 1,060 crore the previous year.

Ola Electric, in contrast, saw its revenue fall 10% to INR 4,514 crore, and its losses widened to INR 2,276 crore from INR 1,584 crore in FY2024. Ather’s promoters currently hold 42.09% of the company, with co-founders Mehta and Jain owning 11.19% and Hero MotoCorp holding 30.9%.

Investor Confidence: Ather’s Market Cap Tops Ola

Investors have rewarded Ather’s steady approach. On a recent trading day, Ather’s shares surged 4.78%, lifting its market capitalization to INR 23,601 crore, while Ola Electric fell 2.54% to INR 23,200 crore. This marks the first time Ather’s market value has surpassed its larger rival, highlighting growing investor confidence in the Bengaluru-based startup.

Technology and Product Updates Driving Growth

Ather:

- Launched the next-generation EL scooter platform, enhancing manufacturing efficiency and reducing component costs.

- Plans to expand dealership presence to 700 outlets by FY26 and introduce lower-priced models for mass adoption.

Ola:

- Introduced a rare-earth-free ferrite motor, reducing dependency on imported materials.

- Focused on operational restructuring and workforce optimization to improve efficiency.

Despite technological advances, Ola continues to face challenges with profitability and cost management, whereas Ather’s innovations are supporting steady growth and investor confidence.

Ola Electric: Ambitious Scale Meets Operational Challenges

Ola Electric has demonstrated impressive ambition but faces a more turbulent path:

- Recovery in Stock Price: Recent upticks are attributed to favorable policy tailwinds and improved production scale.

- Technology Innovation: Introduction of rare-earth-free ferrite motors to reduce dependence on costly imported materials and improve long-term sustainability.

- Operational Restructuring: Workforce optimization and efficiency measures are underway, signaling a focus on reducing operating costs.

Key Concerns:

- Ola continues to grapple with consistent losses, high input costs, and weak margins.

- Profitability remains uncertain despite technological upgrades, meaning investor confidence is highly sensitive to execution and future product launches.

Analyst Insight:

“While operational improvements are positive, near-term valuation and execution risks remain key. Upcoming launches and cost structure improvements will be critical to regaining investor trust,” — Kalp Jain, INVasset PMS.

The Ather Advantage: Engineering as a Superpower

For Ather CEO Tarun Mehta, the company’s strength lies in engineering discipline, not just scale.

“Volume has played a minimal role in unit economics over the years,” Mehta explains. “There’s a ton of value engineering, process optimization, and technology improvement, that’s our superpower.”

That engineering-first philosophy seems to be resonating with both customers and investors, a stark contrast to Ola’s volume-driven approach that now faces pressure from declining sales and mounting expectations.

Conclusion

Both Ather Energy and Ola Electric are set on ambitious paths in India’s rapidly growing EV market, but their strategies differ markedly. Ather Energy has taken a steady and disciplined approach, emphasizing engineering excellence, operational efficiency, and sustainable growth. Ola Electric, on the other hand, has pursued aggressive expansion and scale, though this approach has exposed the company to profitability pressures and execution risks.

FAQs

Which is better: Ather Energy or Ola Electric in India?

Ather Energy currently leads in market share, consistent sales growth, and investor confidence. Ola Electric faces operational challenges and declining sales despite its aggressive expansion strategy.

What are the key differences between Ather and Ola’s growth strategies?

Ather Energy follows a disciplined, gradual expansion focused on customer satisfaction and engineering excellence. Ola Electric emphasizes aggressive scale and nationwide reach but struggles with profitability.

What technology innovations are driving Ather Energy’s growth?

Ather launched the next-generation EL scooter platform to enhance manufacturing efficiency, reduce component costs, and expand its dealership presence to 700 outlets by FY26.

Leave a Reply