This article is contributed by authored By Satinder Aggarwal, Founder, EQBAC

Corporate cash reserves typically sit idle, waiting for emergencies or major investments. But there’s a growing recognition that these funds could serve a dual purpose: protecting the business whilst actively supporting employees through welfare programmes, performance bonuses, and meaningful benefits.

The conventional approach treats reserves as untouchable safety nets. Companies accumulate surplus cash, park it conservatively, and only draw from it during crises.

Employee benefits remain separate, funded through operational budgets with standard insurance policies and fixed compensation. This separation made sense decades ago, but workplace expectations have shifted dramatically.

Working individuals are increasingly valuing flexibility and genuine support during critical life moments. Rigid benefit structures often miss the mark, offering generic packages that don’t align with individual needs. Meanwhile, companies face rising retention costs and engagement challenges. The answer might already exist in their balance sheets.

It’s Time To Rethink Corporate Reserves

Internal savings funds come in various forms including operating surpluses, strategic buffers, or dedicated investment vehicles. Unlike working capital needed for daily operations, these represent accumulated profits or funds set aside for non-operational purposes. The shift happening now involves changing their intent from purely defensive holdings to active tools for workforce support.

Companies can structure these as employee welfare endowments, profit-sharing pools, or flexible benefit reserves. The financial security remains intact, but the funds actively support the workforce by improving wellbeing and engagement.

Let’s Look At Some Real-World Applications

Some organizations channel internal funds toward comprehensive family health insurance, subsidised loans for personal needs, cultural programmes, and performance-based bonuses. When employees feel genuinely supported beyond their paycheques, satisfaction and retention improve measurably. The connection between financial security and workplace loyalty becomes tangible.

Profit-sharing offers another model. Very recently, a major airline distributed 12.2% of profits directly to employees through structured programmes. This creates clear alignment between company performance and individual rewards. Employees see how their contributions affect their compensation, which naturally drives engagement and commitment.

Now while startups face tighter financial constraints, they also have the possibility to demonstrate more creativity.

For example, a startup could establish retirement plans, flexible stipend programmes, and group life cover as alternatives to salary increases. These cost less than equivalent cash raises whilst delivering meaningful value.

Another adaptable practice could be partnering with professional employer organizations to pool risk and reduce administrative burden, making sophisticated benefits accessible even with limited resources.

Are There Practical Funding Models?

Several structures can prove particularly effective.

Profit-sharing pools allocate a fixed percentage of annual profits each quarter for either cash distribution or welfare programmes like health support and education grants. This creates transparency around shared success.

Savings-linked welfare programmes combine contributions from both sides. Automatic payroll deductions go into family security funds, matched by the employer. Employees access these for emergencies, healthcare, or dependent education. The structure encourages personal saving whilst building meaningful safety nets.

Dynamic bonus reserves maintain rolling funds from operational surpluses, enabling spot bonuses for project milestones, innovation, or crisis support. Unlike rigid annual bonuses tied to year-end performance, dynamic reserves allow real-time recognition of contributions.

Tax-efficient benefit plans use structures like flexible spending accounts, health savings accounts, and wellness stipends. These maximise value by reducing tax burdens for both parties whilst delivering targeted support where it matters most.

Is There A Need Of Personalization?

Definitely.

Generic benefits programmes waste significant resources. One employee needs childcare support, another values professional development, a third prioritizes healthcare for ageing parents. A uni-dimensional approach may force identical packages on everyone, leaving substantial value unclaimed and unused.

Savings funds are meant to enable genuine personalization. Employees should be able to direct benefit allocations toward their actual priorities. Depending upon the human resource dynamics, a company could offer wellness allowances, learning subsidies, or family support options. Another organization could fund team experiences, retreats, or collaborative projects that build culture and motivation organically.

This approach dramatically increases utilization rates. When employees choose benefits aligned with their needs, they actually use them.

Organizations could also use savings funds to address employee financial health through coaching, payroll advances, and even payroll-linked loans at below-market rates. These interventions tackle real financial stress without forcing employees toward external, often predatory, lending options.

The reasoning is straightforward. Financially stressed employees show lower productivity, greater distraction, and higher turnover. Supporting financial wellness through company-backed programmes reduces these issues whilst building genuine loyalty and trust. Unused benefits represent wasted investment. Personalization solves this whilst simultaneously increasing perceived value and appreciation.

What’s Being Tested In The Corporate World?

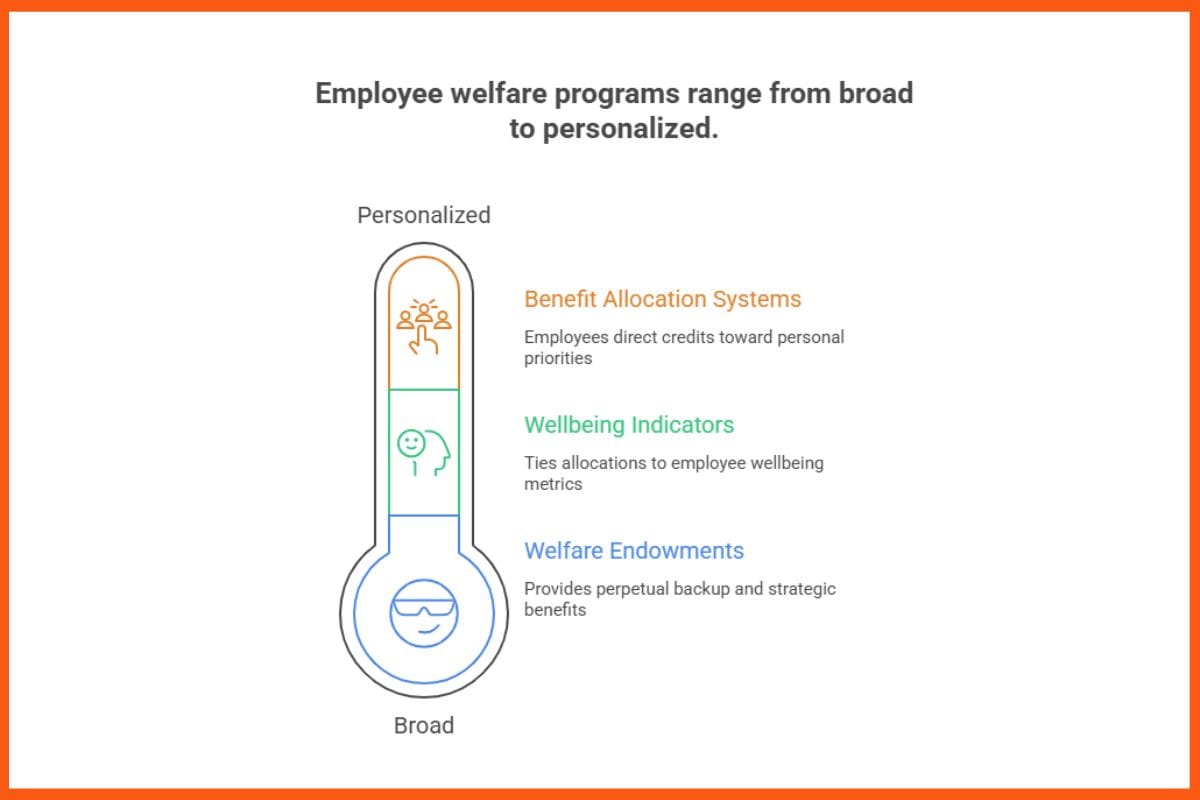

Sophisticated organizations establish dedicated welfare endowments, growing them through conservative investments. These function as perpetual backups since they are instantly accessible for crisis payouts but also funding strategic annual benefits when not needed for emergencies.

This creates predictable long-term engagement whilst building psychological security. Employees know genuine support exists, reducing anxiety and increasing loyalty. For younger companies where rapid salary increases aren’t feasible, these programmes offer meaningful alternatives that deliver authentic value.

Some organizations are exploring benefit allocation systems where employees receive credits they can direct toward priorities they value most: wellness programmes, travel, professional development, or family support. This hyper-personalization minimizes unused funds whilst generating data that helps refine benefit schemes continuously. Others tie welfare allocations to aggregate employee wellbeing indicators like productivity, retention, and survey sentiment rather than purely profit-and-loss metrics. Allocating reserves to preventive health stipends, psychological support, and family care gets benchmarked against these indicators, turning benefit spending into measurable returns on investment.

The Practical Reality

Corporate savings funds hold the potential of becoming engines of employee wellbeing, retention, and engagement. The capital already exists on balance sheets. The question becomes whether organizations will activate it strategically.

This requires shifting mindset from purely defensive cash management to integrated workforce investment. The companies making this transition may observe measurable improvements in retention, engagement, and overall workplace satisfaction. The financial stability remains intact whilst simultaneously creating genuine value for the people driving the success of the business.

The corporate piggy bank, as the savings funds could be called, is a valuable investment opportunity for any organization looking to shift its approach from passive safety nets to active tools that support employees through life’s challenges, recognize contributions meaningfully, and build workplaces where people genuinely want to stay and contribute.

Leave a Reply