This article has been contributed by Mr. Kaushik Chatterjee, Founder & CEO of lendingplate

India’s financial ecosystem is defined by sharp contrasts. On one hand, we have Unified Payments Interface (UPI) transactions, one of the world’s most progressive financial ecosystems crossing 20 million per month and digital wallets spreading across urban India. On the other hand, millions of small businesses, rural entrepreneurs and gig workers still lack access to formal credit. This divide highlights the key role of Non

Banking Financial Companies (NBFCs) in traversing the financial inclusion gap.

Traditionally, in India, access to credit was subject to formal documentation and collateral. Traditional financial institutions, frequently restricted by cautious policies and legacy systems often turned a blind eye towards borrowers without official credit histories. The consequence? Marginalization of daily wage earners, micro entrepreneurs, women-led enterprises and small traders.

NBFCs have taken on the role of filling this gap. They first did this via on-ground networks and then through digital platforms. The time is evolving. It took weeks of verification and physical paperwork to get one thing done but now the same is possible on a smartphone in minutes. This change has redefined the profile of borrowers, helping people from various backgrounds to access financial services that were once out of their reach.

Speed, Simplicity, and Scale

The crux of digital lending stands on simplicity, scale and speed. NBFCs make lending decisions in real-time with the help of automated credit assessment tools, powered by machine learning and AI. Processes that once took days and sometimes weeks are now completed within seconds. Loans are now disbursed smoothly, thanks to the seamless integrations into PAN, GST, Aadhaar and bank APIs. Electronic signatures, digital disbursal mechanisms and paperless Know Your Customer (KYC) processes have made it much easier for first-time borrowers.

In today’s time, customers can complete the loan journey right from application to repayment without physically going to a branch. Additionally, NBFCs grow beyond metropolitan areas reaching Tier 2 and Tier 3 markets with the help of cloud-native infrastructure. Primarily, NBFCs have become the first formal financial institutions to give credit to these areas, bridging key gaps in financial inclusion. These capabilities are supported by a strong landscape of fintech collaborations, new regulatory rules and data analytics, all working in tandem to make credit more intelligent and inclusive.

Data as the New Collateral

Traditional credit scoring systems are mostly dependent on previous borrowing history. But many potential borrowers don’t have such histories. NBFCs are resolving this bottleneck by using alternative data sources including GST filings, transaction patterns and utility payments to evaluate creditworthiness. Machine learning models evaluate these data points to make more detailed profiles of borrowers, helping NBFCs to give credit to people who were once considered uncreditworthy.

This method has been mainly groundbreaking for thin-file customers who may not have traditional documentation but have robust digital footprints. At its core, data has become the new technology, the new collateral and the new trust engine.

Building Trust in the Digital Age

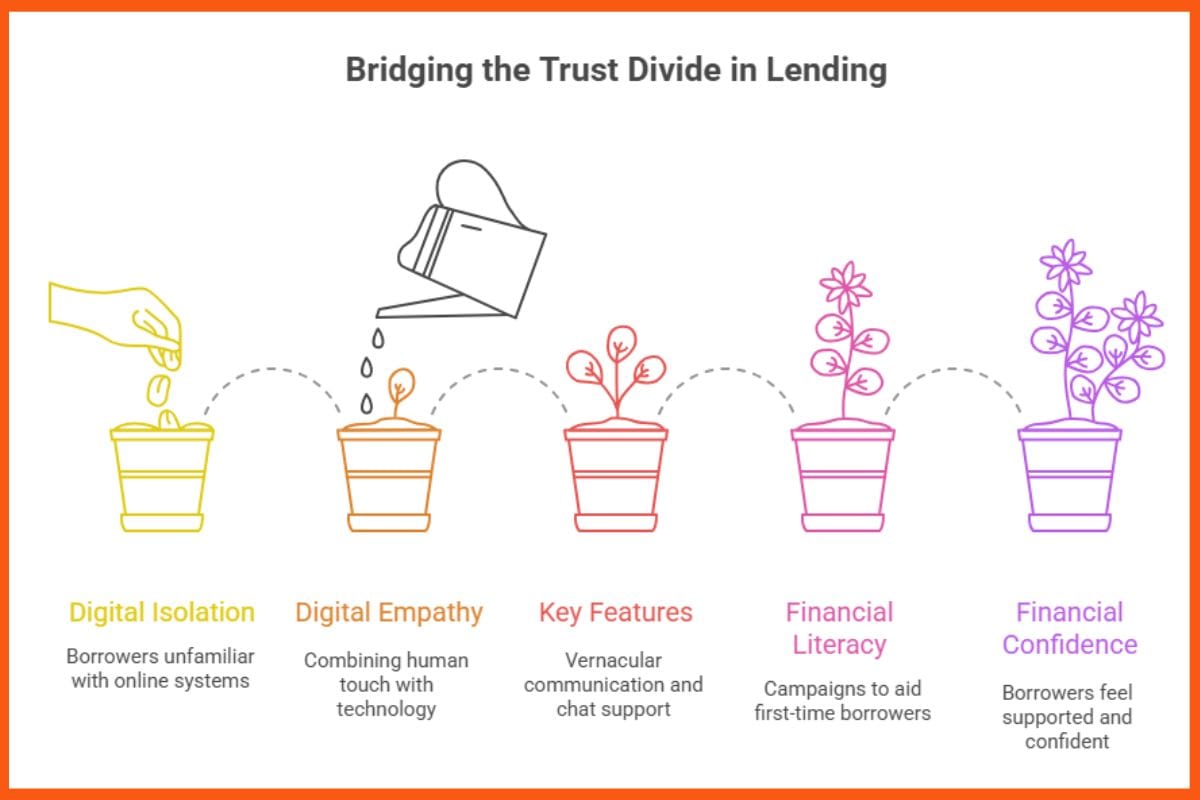

The fundamentals of lending lie in trust. Yes, digital interfaces have indeed made credit more accessible. However, there is a flip side to it too. They risk isolating borrowers who are not familiar with online systems. NBFCs are bridging this trust divide via digital empathy, combining human touchpoints with technology.

Borrowers now feel supported, thanks to key features like vernacular communication, chat-based customer support and video KYC assistance. Various NBFCs are investing in campaigns around financial literacy to aid first-time borrowers in understanding EMI structures, credit discipline and repaying responsibly as the goal is to build lasting financial confidence.

Regulatory Evolution and Responsible Growth

The Reserve Bank of India (RBI) has played a vital role in carving a responsible digital lending ecosystem. Establishing rules for grievance redressal, data privacy and transparency has ensured that innovation remains neutral with consumer protection.

For NBFCs, compliance isn’t a hurdle; it’s an enabler. The developing regulatory framework provides stability and credibility, promoting collaborations with larger financial institutions and fintech players. Responsible lending practices, robust credit evaluation, and fair collection mechanisms are now integral to the NBFC ethos. In addition to growth, the focus is also on sustainable growth, one that empowers both borrower and lender.

Potential Hurdles Ahead

Digital lending faces challenges right from customer awareness gaps to cybersecurity risks. Urban India has made digital money a part of its mundane life but many borrowers in rural areas still struggle with digital literacy, making them vulnerable to fraud or misinformation.

Furthermore, with tight-knit competition, NBFCs need to protect against overusing and ensure safe credit evaluation even at scale. To maintain stability and trust in the long run, investing in digital literacy and building data security infrastructure is essential.

Building a Future of Empowerment

The next chapter of India’s financial inclusion story will be written at the intersection of innovation, intelligence, and intent. With the convergence of fintechs, NBFCs and regulatory frameworks, we are moving toward a credit ecosystem that is digital as well as deeply personal where every borrower’s situation, requirement and potential can be understood vis empathy and data.

Account Aggregators, India Stack 2.0 and Open Credit Enablement Networks (OCEN) will further speed up this change helping NBFCs to give context-driven, affordable and timely credit. Finally, when the gig worker buys his first vehicle, the small business owner expands her shop, the farmer invests in better tools, and when we move beyond financial inclusion toward true financial freedom. And this is possible when the capital starts flowing smoothly to where it’s required the most.

Essentially, lending is more than just disbursing loans; it’s about making dreams come true. As NBFCs, our mission is to ensure that every person regardless of gender, background or geography has the chance to participate in India’s growth trajectory. That’s the real dividend of digital lending and a promise of a more secure future.

Leave a Reply