Most advice given to startups and other growing businesses is often focused on the first year of operations as this is the most critical for ensuring that the business can survive into the future. However, many second-year considerations aren’t as widely discussed, even though they’re just as important for businesses that want to continue the growth they enjoyed in year one. Let’s look at a few important shifts that take place during the second year of operations, how best to navigate them, and a few steps to ensure your growth and success continue.

Changes in Personnel and Human Resources Management

The biggest shift in year two often comes down to people. In year one, your team is small, and HR feels manageable. But as you grow, you’ll need more employees to serve clients and scale operations. Along with new hires comes expanded HR needs like benefits, compliance, payroll, and policies.

One of the best ways to accomplish this is through Human Resources outsourcing, where a company uses PEO, or a Professional Employer Organization. These organizations handle back-office administrative tasks and human resource needs, allowing company leadership to focus on the revenue-generating activities that drive the company forward. HR outsourcing via a PEO for small businesses can also help you manage compliance, benefits administration, and more.

The biggest benefit for most growing businesses is that owners can refocus their time and efforts. Instead of spending hours filling out paperwork to make sure that your business is in compliance with state and federal laws, you can focus on your areas of passion. Most people don’t start businesses because they love filling out HR paperwork.

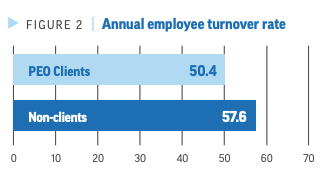

Source: NAPEO September 2024

Using a PEO for small business HR can significantly increase a company’s bottom line over time by redirecting time and money previously earmarked for HR concerns. Because PEOs handle companies across the country with thousands or even millions of employees, they can offer better benefits at lower rates for both you and your employees. In fact, the average ROI of working with a PEO is just over 27% according to NAPEO research.

According to a 2024 Gartner study, HR costs the average company 1.47% of its annual budget, excluding wages. If you’re spending more than 1.47% of your time handling HR-related concerns, it may be a good idea to hire a PEO so you can focus on other aspects of your growing business.

Examine Spending and Update the Company’s Financial Outlook

Year two is a great time to review last year’s expenditures against your budget and identify ways to optimize. For example, imagine a company has a budget line item of $300 every month for marketing and advertising costs. Every month, the actual spending is between $295 and $299. On one hand, it’s good budgeting because the company set a goal and managed to get within 2% every month.

However, the company would also be remiss if it didn’t look at the analytics behind the spending to find out whether or not that $300 is being spent optimally. If the money is being used to boost advertisements on all forms of social media, the metrics should be analyzed to make sure that the spending is worth it.

One-hundred dollars a month for boosted Instagram advertisements isn’t a lot of money, but if those impressions don’t result in conversions (i.e., people laugh and like the post but then move on and don’t become paying customers), the money isn’t being used efficiently. That money could be reallocated to another department or used to boost successful posts on Facebook or another platform that has a higher conversion rate.

You’ll also want to monitor your company’s cash flow and make sure everything’s in order. According to Forbes, 82% of businesses fail due to insufficient cash flow, and 20% have no budget at all. By making a budget, changing it as necessary, and ensuring that your company still has enough revenue to stay in business, you’ll end up far ahead of your competition.

After the budgetary review, you can reallocate funds as needed to ensure that all of your spending helps the business grow and is used to its full potential. This will help you set up and achieve your goals for year two and beyond.

Additional Points to Consider for Year-Two Business Ownership

After considering using payroll services for small businesses and reanalyzing your budget to ensure proper usage and focusing on achieving goals, here are a few more things to consider.

First, add a little extra focus to the existing clients in your portfolio. They’ll take notice and potentially add extra services to their contracts, which is even better for your company’s bottom line.

Second, set new attainable goals and milestones for your company. You’ve overseen a full year of success, and now it’s time to think about growth. Can you add 10% more clients to your roster by year’s end? Perhaps you can increase sales to existing clients or increase the conversion rate on your digital advertising.

Finally, consider increasing your market research. Sales are good, but could they be better? Is there a new demographic you could be reaching? By constantly looking for new clients and revenue streams, you can avoid unexpected shifts in the market that could be disastrous.

Critical Shifts in Year-Two Recap and Final Thoughts

The second year of a business should be primarily focused on growth and expansion. You’ve successfully achieved your goals of running a successful business on your own terms. Now the time has come to make sure that business continues to thrive in the years to come.

By outsourcing basic functions like HR, thoroughly analyzing the budgets, focusing on existing clients to ensure their continued loyalty (and perhaps even the expansion of their contracts), and increasing your market research, your business can continue to be successful.

Leave a Reply