This article has been contributed by Neeraj Gupta, GM-PeX Head Global (India/Africa), Bharti Airtel Ltd

Reflecting on my 17 years in the Indian telecom finance domain, the transformation has been nothing short of breath-taking. I began my career in an era of paper ledgers/Tally and manual reconciliations, where the sheer scale of our operations was a constant, looming challenge. Today, I lead finance teams in a world driven by data, automation, and intelligence where technology is not just an enabler but the foundation of our function.

The financial complexity of the telecom sector is unique. It’s a high-volume, capital-intensive industry where billions of dollars flow through our systems daily. We process millions of customer recharge transactions, manage complex settlements with a vast network of channel partners, and account for a massive base of fixed assets. In India, with a mobile tower needed every 300 meters or less in dense urban areas post-5G, our fixed asset register contains over 150 million individual assets.

In this environment of extreme volume and velocity, leveraging technology is not an option; it’s the only way to ensure efficiency, accuracy, and compliance. The catalysts for the current revolution are Artificial Intelligence (AI) and Robotic Process Automation (RPA) and other emerging technologies , which are reshaping finance from a reactive, back-office cost center into a proactive, strategic partner to the business.

However, the journey isn’t a simple plug-and-play affair. It began with basic RPA handling repetitive, rule-based tasks, which delivered quick wins. But many organizations hit a plateau, finding it difficult to identify new high-ROI opportunities. The key to unlocking sustained value lies not in the technology itself, but in the strategic decision to embed AI within a broader agenda of fundamental process transformation.

Redefining Revenue: From Reconciliation to Intelligence

One of our greatest historical challenges was reconciling millions of daily customer recharges across our ERP, billing, and banking systems—a process fraught with the risk of revenue leakage and fraud. To tackle this, we pioneered an industry-first AI-based reconciliation engine. The results were incredible: we achieved massive manpower efficiency and established real-time fraud alerts that prevented significant financial losses.

That was just the beginning. The next wave of technology is moving us from reconciling the past to actively predicting the future.

- Predictive Revenue Assurance: Modern AI and machine learning (ML) frameworks, such as those offered by AWS, Subex, and Neural Technologies, now use unsupervised learning to analyze vast data streams in real-time, detecting subtle anomalies and new fraud patterns that rule-based systems would miss.

- Smarter Cash Flow: ML platforms can scrutinize historical payment data and customer behavior to predict which customers are likely to pay late, forecast Days Sales Outstanding (DSO) with high accuracy, and recommend effective collection strategies from reactive collection to predictive forecasting. This transforms the AR team into a strategic driver of working capital.

- GenAI for Communications & Dispute Resolution: Generative AI is revolutionizing customer interactions. For instance, Billtrust’s GenAI-powered email assistant for collectors has cut the average email response time from eight minutes to just two and a half.

The AR department is no longer just closing the books; it’s becoming a strategic intelligence hub, providing forward-looking insights into cash flow, customer financial health, and risk.

Taming the Beast of Intelligent Asset Management

The scale of our fixed assets is difficult to comprehend—our register exceeds 150 million assets and 30 GB of data. Managing this portfolio without advanced technology would be impossible. The foundation for modern asset management is a powerful, cloud-based ERP system. A landmark example is Vodafone’s migration of its colossal SAP system to Google Cloud, a move that yielded multi-million Euro savings and significant performance boosts.

- The Rise of the Digital Twin and IoT: The next frontier is connecting the physical asset to its digital record in the ERP in real-time. IoT (Internet of Things ) sensors deployed on critical assets like cell towers can monitor everything from energy consumption to structural integrity, streaming live data to the cloud. This data, combined with drone imagery, allows for the creation of a “digital twin” a dynamic virtual replica of a physical tower. Using this twin, engineers can remotely monitor an asset’s health and simulate the impact of adding new equipment without a physical site visit.

- AI-Powered Predictive Maintenance: This convergence of data enables the most significant leap forward: predictive maintenance. Instead of reacting to failures, leading international operators are already using AI to forecast network failures, reduce downtime, and lower operational costs. The finance team must now work hand-in-glove with network operations, breaking down historical silos and making the CFO’s role more operationally integrated than ever before.

Automating the Engine Room: The Evolution of Accounts Payable

In my own experience, one of our most impactful early automation projects was in Accounts Payable.zWe faced a relentless influx of invoices. By implementing RPA with OCR and ML, we achieved faster processing, reduced errors, and boosted vendor satisfaction. Today, the market has evolved to comprehensive, that manage the entire invoice lifecycle—from intelligent data capture and automated validation to smart approvals and embedded fraud detection, slashing process time by up to 70%.

The next frontier is Agentic AI, which could independently query a vendor about a mismatched invoice and propose a resolution, freeing up finance professionals for truly strategic work.

The value of AP automation creates a positive effect across the business. It extends far beyond the finance department’s P&L. Efficient, error-free invoice processing leads to reliable, on-time payments. This strengthens vendor relationships, giving the procurement team greater leverage to negotiate better terms and secure early payment discounts.

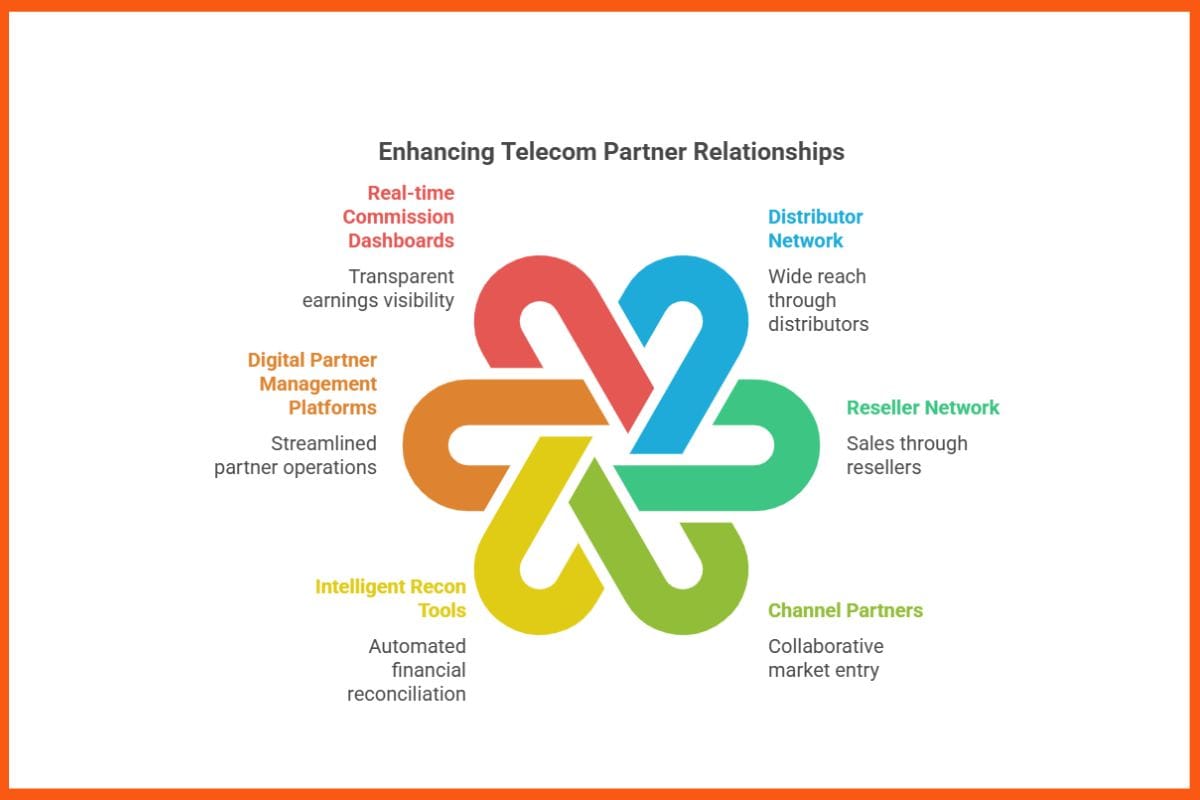

Streamlining the Partner Ecosystem: Customer & Channel Accounting

For a telecom operator, our vast network of distributors, resellers, and channel partners is a critical route to market. This efficiency extends to the complex world of channel partner finance. Intelligent Recon tools, Modern Digital Partner Management platforms automate everything from partner onboarding to the settlement of intricate revenue-sharing models. A persistent pain point for partners is a lack of visibility into their earnings; new systems now provide real-time commission calculations via dedicated dashboards. In a competitive market, a financial relationship built on speed and transparency becomes a key differentiator to attract and retain the best partners.

Navigating the Maze: Technology in Taxation, Compliance, and Reporting

The regulatory landscape is a complex maze. Our initial steps in automating GST compliance and related-party disclosures have paved the way for a more integrated approach to tax, compliance, and reporting.

- TaxTech: Our journey began with a cloud-based tool to manage GST compliance. For a company of our scale, manually handling the intricacies of the GST regime, reconciling GSTR-1A and 2B, managing input tax credits, and placing vendor payment holds based on filing status, is simply not feasible. These available cloud available who offer direct API integration with government portals and ERP systems, automating tax calculations and filings.

- Governance, Compliance, and the Rise of RegTech: Legacy GRC systems, born from regulations like SOX, buried finance teams in a flood of “false positive” alerts. Today, AI-powered RegTech is flipping the model from reactive to proactive. Instead of reactive, Continuous Control Monitoring (CCM) analyzes 100% of transactions in real-time. System-Based Financial Delegation of Authority (FDoA) moves beyond static policy documents, embedding and actively enforcing approval rules directly within core financial systems. Meanwhile, intelligent document analysis combines AI and OCR to spot sophisticated invoice fraud that rule-based checks would miss. This shift transforms compliance from a noisy, reactive cost center into an intelligent, proactive shield, allowing human experts to focus on strategic risk instead of chasing ghosts in the machine.

- AI-Driven FP&A: The next evolution in reporting is AI-driven Financial Planning & Analysis (FP&A). Modern platforms like Anaplan and Oracle Cloud EPM allow teams to model hundreds of potential business scenarios in seconds and generate more accurate, rolling forecasts that continuously learn from new data. A revolutionary feature is natural language interaction; a CFO can now ask a dashboard in plain English, “What was our gross margin trend last quarter?” and receive an instant answer, democratizing data access and accelerating decision-making.

Overall Summary

The following table provides a roadmap of this transformation across the key verticals of telecom finance, which we discussed and outlining the journey from traditional challenges to the value unlocked by next-generation technology

The Unspoken Prerequisite: Process Before Technology

The most critical lesson from my 17 years is this: technology applied to an inefficient process will only magnify the inefficiency. The successes I’ve witnessed were not just technology projects; they were business transformation projects. We didn’t just buy an AI engine; we fundamentally redesigned the entire workflow from the ground up.

This process-first philosophy is the unspoken prerequisite for success. Research by BCG found that embedding AI initiatives into a broader transformation agenda increases the probability of success significantly. The greatest returns come from eliminating redundant steps, not just making existing ones faster.

Conclusion: The Dawn of the Autonomous Finance Function

Across telecom finance, a profound transformation is underway. AR is now a predictive revenue hub, asset management is an intelligent, real-time function, and reporting is a dynamic, forward-looking dialogue. The convergence of AI, RPA, and specialized cloud applications is dissolving traditional silos, paving the way for the ultimate goal: the Autonomous Finance Function.

In the future, Agentic AI will handle complex exceptions, digital twins will autonomously trigger financial forecasts, and FP&A models will self-correct in real-time. We are moving beyond simply recording financial history to an era where we can actively predict and shape our economic future. The finance professional of tomorrow is not an accountant, but a strategist, analyst, and data scientist, empowered by intelligent technology to drive value at every turn. The revolution is here, and it is autonomous.

Leave a Reply