The future for cloud revenue powered by AI is looking optimistic, which is why investors are rushing to bet money on Oracle. On Wednesday (September 10, 2025), Oracle’s stock price skyrocketed by more than 32% in premarket trading. As these numbers seem to go up and up, the CEO, Safra Catz, draws a road map for OCI revenue. According to Oracle, its AI-powered cloud business could make $144 billion by 2030. Such a whopping number is a wild prediction. Are these predictions by the company mere bold statements, or do they hold any practicality in their future? Learn more.

Big Revenue Prediction by Safra Catz

Oracle makes big predictions stating that an AI-powered cloud business could make up to $144 billion by 2030. And the CEO, Safra Catz, draws a growth road map for OCI revenue:

- 2026 fiscal year: $18 billion (77% growth)

- Next years: $32B → $73B → $114B → $144B

Interestingly, the company is expected to make less than $20 billion this fiscal year (2026). However, the stock is driving significant investment, all thanks to the promising growth of AI-powered Cloud Solutions.

But Oracle’s Current Earnings Were Weak

According to the Q1 results for fiscal year 2026 (reported by Oracle):

- The revenue is $14.9B (now this number is slightly lower than Wall Street’s $15B expectation).

- And the earnings per share would be $1.47 (it is also slightly below $1.48 expected).

- Generally, such a weak revenue performance should hurt the stock (because it missed expectations). But the future outlook changed the game for Oracle. \

Big AI Customers of Oracle

According to Oracle, it has signed major cloud contracts with tech giants like:

- OpenAI

- xAI (Elon Musk’s company)

- Meta

Now, this is important for investors as it shows how big companies trust in Oracle.

Contract Backlog (Future Revenue Promised)

Oracle highlighted RPO, meaning the value of all customer contracts Oracle has signed but not delivered yet. This is significant because Oracle signed four multibillion-dollar contracts with three customers in Q1.

Now, what does this mean? It means Oracle has several guaranteed business opportunities in the pipeline (over the coming years). This also pushed RPO up 359% to $455B. The company is expecting RPO to cross $500B soon.

Oracle Will Bet This Money On? (Infrastructure & Chips)

To reach such a bold revenue goal, Oracle needs to invest money in AI, such as:

- Buying tons of Nvidia GPUs (they are AI chips).

- Plus, renting them through its cloud service (OCI), competing with Amazon AWS and Google Cloud.

For the same reason, the company is pouring big money into capital expenditure (meaning spending on data centers and infrastructure):

- In 2025: $21B

- By 2026 (previous outlook showed): $25B

- By 2026 (the new outlook shows): $35B

Cost Cutting

- Recently, Oracle has been in the news for laying off people.

- Plus, the company also cut the cash raises and bonuses for its employees. All these cash changes are tightening Oracle’s pockets only to fund its AI plans.

Stock Performance

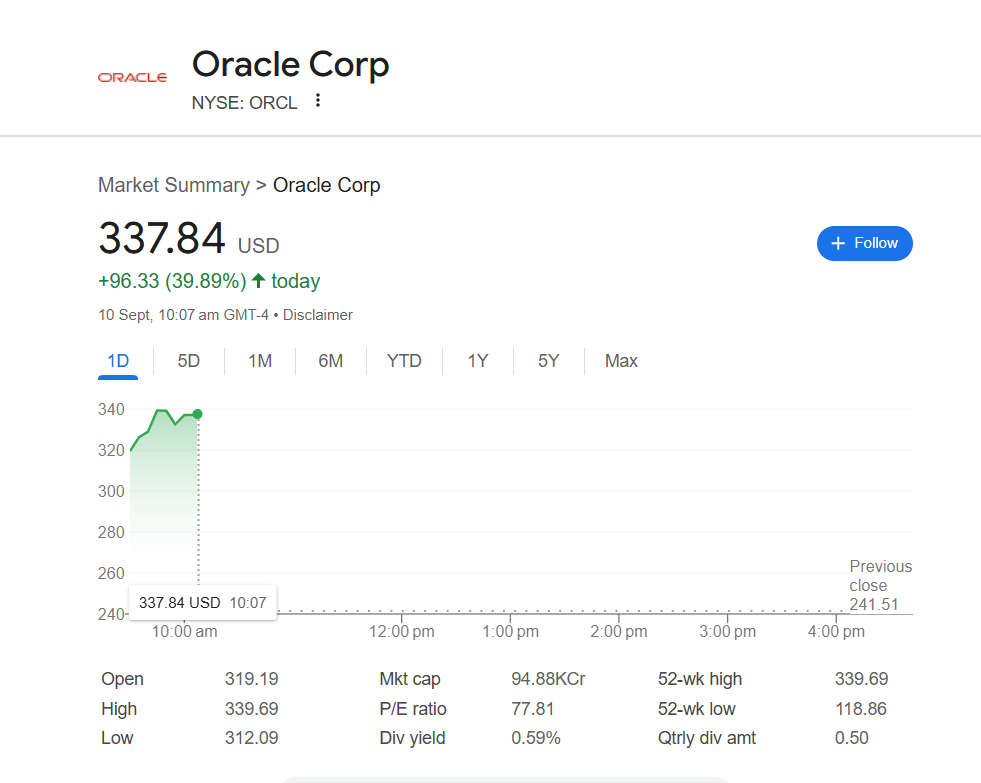

Oracle’s AI momentum is paying off for the company well, because its stock has soared more than 70% in the past year.

The $30B OpenAI Deal (Speculation Only)

Well, Oracle revealed that it’s in contract with a customer paying $30B/year starting in 2028.

Many media reports speculate that this high-paying customer could be OpenAI. However, neither of them confirmed the matter.

As it was making news, the investors were hoping for an official confirmation, although Oracle remained silent at the moment.

Oracle’s Big Bet on Stargate AI Project

Stargate is a huge 500B AI infrastructure project by Oracle, OpenAI, SoftBank, and President Donald Trump. The project came to light to build big AI data centers, including one in Abilene, Texas.

Status on the Project:

- According to OpenAI, certain parts of the project are up and running.

- SoftBank admits to delays in the project.

CEO Safra Catz said, “Stargate is not formed yet… but some of our business with OpenAI is part of our future.”

At the moment, the investors have no idea about how big Oracle’s role in Stargate will be.

Leave a Reply