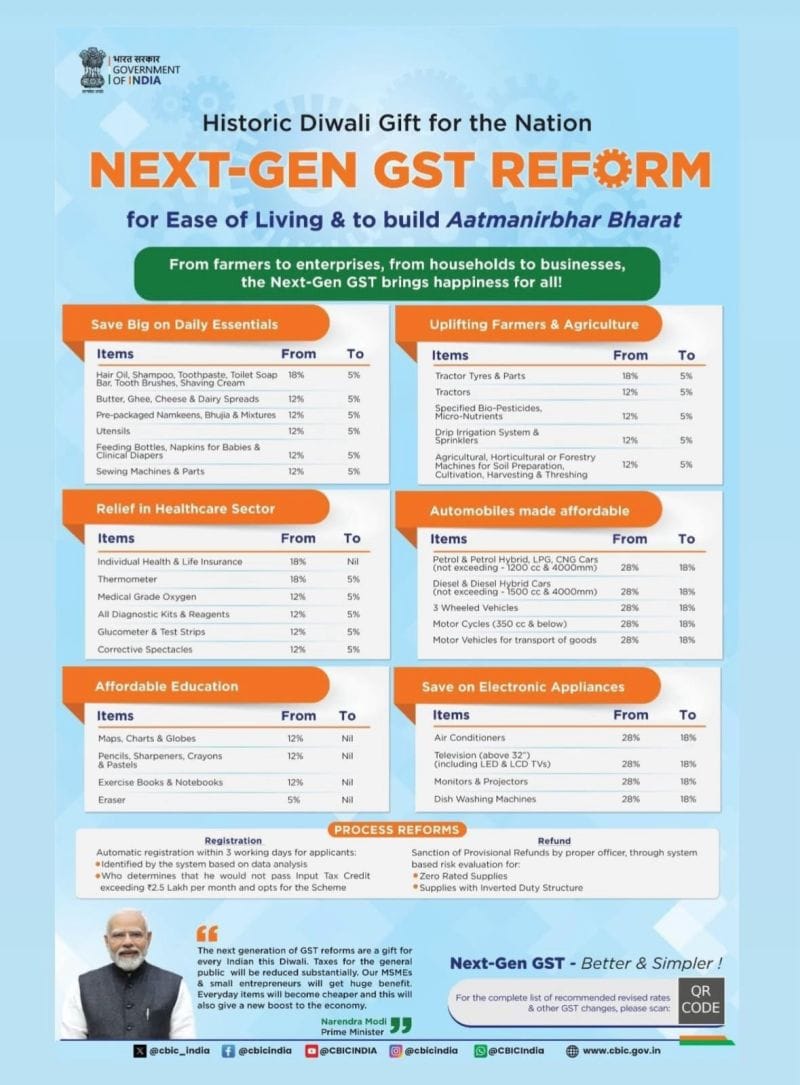

Finance Minister Nirmala Sitharaman and the GST Council announced what we can only call the good news. GST on households will now be 5% only (down from 18%). This came as a big relief for ‘aam aadmi’ (meaning the middle class). However, for Sin goods (such as tobacco and liquor) and luxury items, the tax rate will increase from 28% to 40%, which is a huge hit. Now, are you still thinking of buying that SUV you had on your vision board in 2025? How’s the news GST regime going to affect your life (and lifestyle) from September 22? Learn more

What Nirmala Sitharaman Announced?

- The four slabs of GST will now be reduced to two slabs, at 5% and 18%. Households will pay 5% GST on food and daily items.

- Whereas for the Luxury goods and Sin goods, people have to pay 40% (up from 28%). The new GST regime will commence on September 22.

The Union Finance Minister, Nirmala Sitharaman, said, “These reforms have been carried out with a focus on the common man. Every tax on the common man’s daily use items has gone through a rigorous review, and in most cases, the rates have come down drastically… Labour-intensive industries have been given good support. Farmers and the agriculture sector, as well as the health sector, will benefit.”

Reasons for Changes?

The 50% tariff by the US on Indian exports is a slap on the face. The government is making efforts to promote Indian businesses, especially local manufacturers, to combat the situation. And so came the new changes:

- To provide some relief to the middle class in the country (the ‘aam aadmi). To make daily essentials affordable.

- To promote small businesses and push the general public to buy more during the festive seasons (like Navratri & Diwali).

- To boost the economy. Well, if there’s more spending, the businesses would grow and contribute to the nation’s economy.

- And ultimately to smooth the effect of Trump’s 50% tariff on India.

Direct Impact on the Middle Class

Here’s a complete breakdown of the impact of the new GST regime on the Middle class:

- There’s no GST at all on ready-made parathas, chapatis, khakhra, pizza bread, or paneer.

- Zero GST on UHT milk (meaning the long shelf-life milk).

- Only 5% GST (it was 12% – 18% earlier) on: soya/plant-based milk, butter, ghee, jam, sauces, namkeen, pasta, cornflakes, biscuits, chocolate, cocoa, dry fruits, nuts, dates.

Personal Care:

- There will be only 5% GST (came down from 18%) on: hair oil, toothpaste, shampoo, and combs.

Household Items:

- Only 5% GST on: kitchenware, tableware, utensils, umbrellas, bamboo furniture, bicycles.

Consumer Durables:

- 18% GST (down from 28%) on big household items like TVs, ACs, refrigerators, and washing machines.

Vehicles:

- For small cars, the GST is down to 18% (from 28%) (petrol up to 1200cc/diesel up to 1500cc, length ≤ 4m). Examples: Alto, Swift, Fronx, Tata Punch, Hyundai i10.

- Bikes (up to 350cc) will now have 18% (from 28%).

- Luxury cars with bigger engines, longer length, for instance, SUVs, will now have an increased GST of 40%.

Insurance & Health:

- Well, there is zero GST on individual health insurance premiums and life insurance premiums (including term life, ULIPs, and endowment plans).

- Approximately 30 specialized drugs for cancer and other rare diseases will be exempt from GST starting September 22.

Leave a Reply